Casual Schedule Vi Of Companies Act

OLD SCHEDULE VI See section 211 PART I.

Schedule vi of companies act. The term infrastructural projects or infrastructural facilities includes the following projects or activities 1 Transportation including inter modal transportation includes the following. Login to BizFile Disclaimer. Section 211 1 of the Companies Act 1956 requires the companies to draw up their financial statements as per the form set out in Revised Schedule VI.

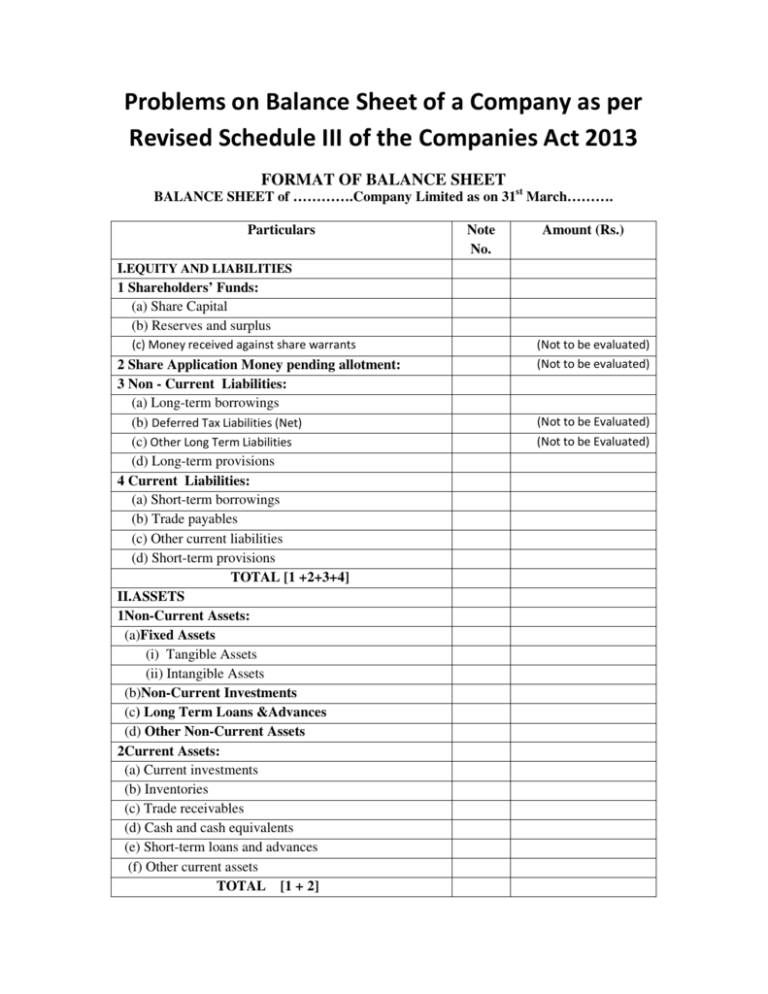

Why do we need to follow Schedule VI the answer is Section 211 of the Companies ActSub section 1 of section 211 makes it mandatory for a company to provide its Balance Sheet in the form set out in Part I of Schedule VI and Sub Section 2 mandates to comply with the requirements of Part II of Schedule VI in drawing up its profit and loss account. 1 Subject to any leave which the Court may give pursuant to an application under subsection 3 a person who is subject to a disqualification or disqualification order under section 56 57 58 59 or 60 of the VCC Act must not act as director of or in any way whether directly or indirectly take part in or be concerned in the management of any company or any foreign company to which Division 2 of Part. MAIN PRINCIPLES OF REVISED SCHEDULE VI The requirements of the Companies Act 1956 and the Accounting Standards will prevail over the Revised Schedule VI.

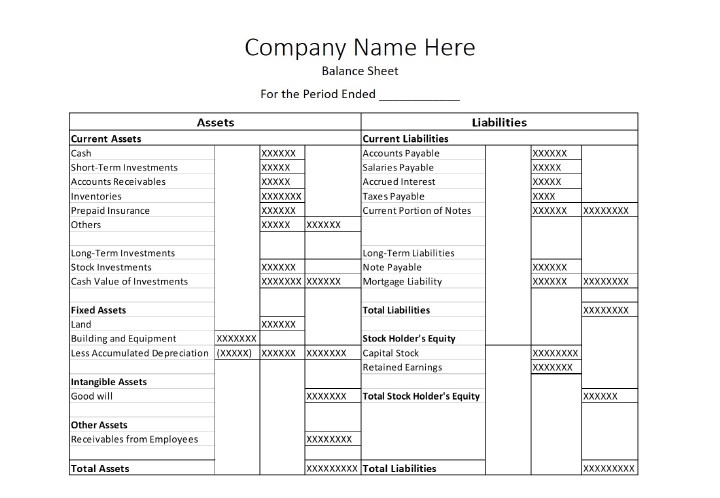

General Introduction to Schedule VI to the Companies Act-1956 Schedule VI to the Companies Act 1956 deals with the form of Balance Sheet and Profit and Loss Account and classified disclosure to be made therein and it applies uniformly to all the companies registered under the Companies Act 1956 for the preparation of financial statements of an accounting year. No warranty is given that this website or any. New schedule vi see section 211 general instructions for preparation of balance sheet and statement of profit and loss of a company in addition to the notes incorporated above the heading of balance sheet under parts a and b.

It is also imperative to note at the very outset that like its predecessor Revised Schedule VI doesnt apply to banking or insurance companies. In case of conflict requirements of the Companies Act 1956 Accounting Standards shall prevail over Schedule VI Information currently disclosed as schedules and notes to accounts now clubbed as notes to accounts Consistency in definition of terms used will carry the meaning as defined by the applicableAccounting Standards. It requires companies to disclose gross profit in the profit and loss account.

Except for addition of general instructions for preparation of Consolidated Financial Statements CFS the format of financial statements given in the Companies Act 2013 is the same as the revised Schedule VI notified under the Companies Act 1956. SCHEDULE VI See sections 55 and 186 The term infrastructural projects or infrastructural facilities includes the following projects or activities 1 Transportation including inter modal transportation includes the following a roads national highways state highways major district roads other district roads and village roads including toll roads bridges. The original schedule VI.

Revised Schedule VI clarifies that the requirements mentioned therein for disclosure on the face of the financial statements or in the notes are minimum requirements Revised Schedule VI has eliminated the concept of schedule. Changes that have been made appear in the content and are referenced with annotations. The proposed revision of schedule VI to the Companies Act 1956 stipulates multi-step format for the presentation of profit and loss account.

:max_bytes(150000):strip_icc()/ExxonMobilCashflowstatement09-30-2018-5c671f2e46e0fb0001a20a17.jpg)