Fabulous Gaap Accounting For Reimbursed Expenses

Thank you for your responses.

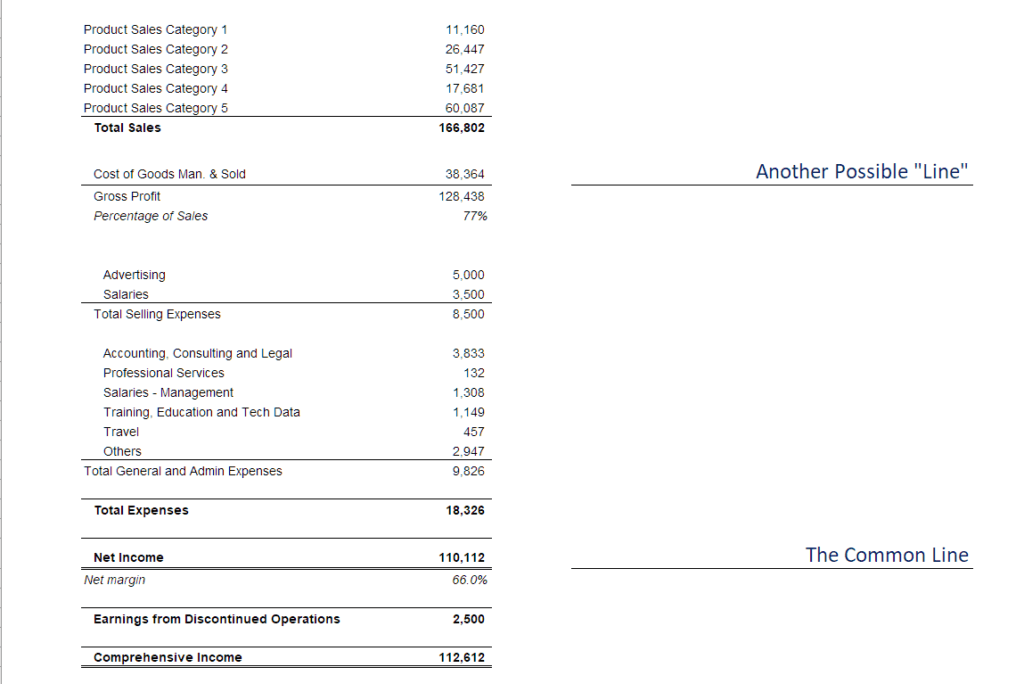

Gaap accounting for reimbursed expenses. The seller records no expense and no revenue. He invoices clients for all expenses flightsmileagefoodmisc expenses and is fully reimbursed. Since the final result for tax purposes is the same between the right way and the easy way you can choose the one that seems the best to you.

While fuel will be reimbursed to him based on original bills so we can book estimated provision for this which can be later on adjusted according to the actual fuel amount consumed. But youre not allowed to do that. The underlying GAAP standard that addresses this issue is the Emerging Issues Task Force EITF issue number 01-14 Income Statement Characterization of Reimbursements Received for Out-of-Pocket Expenses Incurred.

To make an entry for expense reimbursement make a credit entry to decrease the expense and a debit entry to note the reimbursement. Depending on the number of reimbursed employee expenses the business might establish a separate account for each employee in the accounts payable ledger or if the amount is to be reimbursed through wages post the amount to the net wage control account. So by adding paper revenues to your company you are in effect.

You get the same result in your accounting records if you use the sellers reimbursement payment to simply offset those expenses in your records which flushes out the expense. Reimbursement assets are not netted against the related provision loss contingency on the balance sheet. However the expense and related reimbursement may be netted in profit or loss under both IFRS and US GAAP.

When Company B reimbursed Company A for expenses the entry will be Dr Bank Cr Sales in Company As accounts. Validate or refuse with just one click. The problem with your interpretation of GAAP or GAAP itself is that reimbursement is not revenue for clarity sake there is no margin which would be revenue.

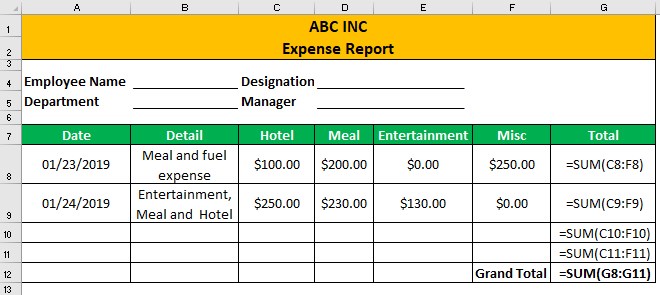

Use the Reimbursable Expenses account when creating Invoices When you create the clients invoice add a line item for each reimbursable expense and use the Reimbursed Expenses income account. 1 Misleading readers of the financials as to your revenue 2 Skewing all ratios and financial measurements. Ad Managing your expenses has never been easier.