Unique Debit And Credit Side Of Profit And Loss Account

Debit side on the left hand side.

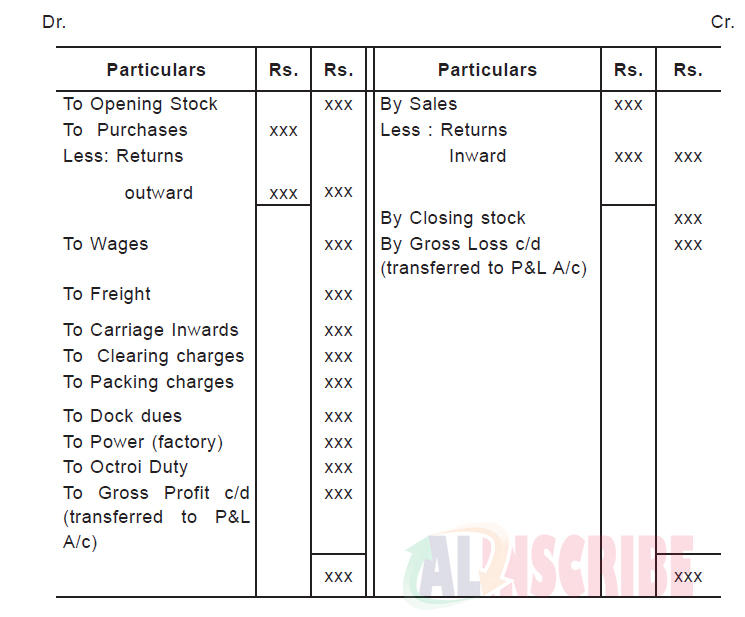

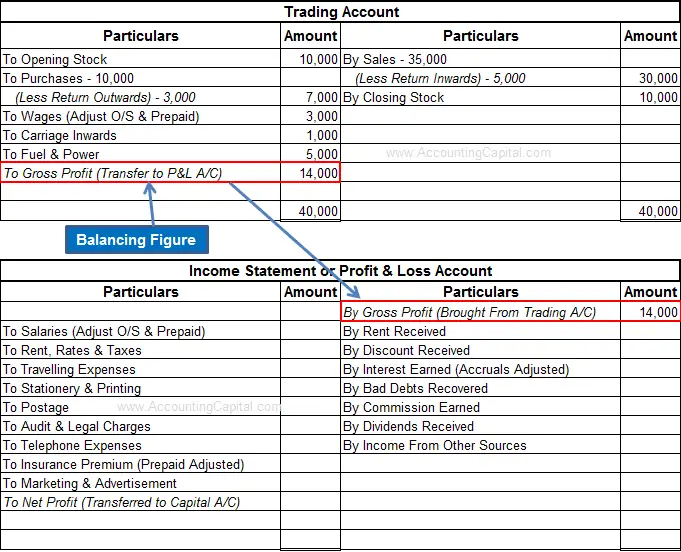

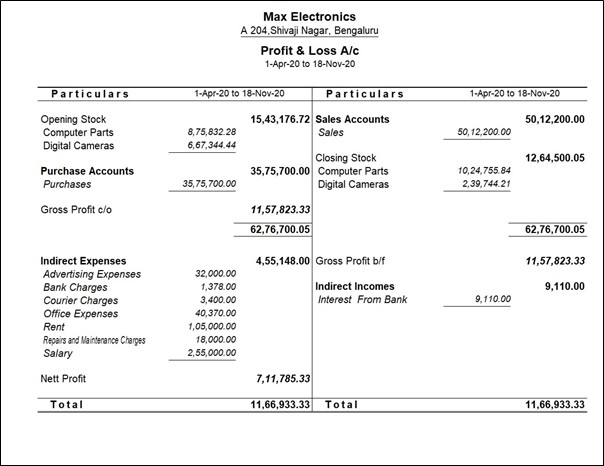

Debit and credit side of profit and loss account. The profit and loss account starts with gross profit at the credit side and if there is a gross loss it is shown on the debit side. The balance of the credit side shown on the debit side of the Profit and loss account is the Net profit for the business for the particular accounting period for which the final accounts are prepared. This note has information about items included in profit and loss account.

The side having the higher balance is known as from that side. The structure of profit and loss statement is divide into 2 broad categories one is the debit side and other is credit side as shown below. The income side it is said to have earned a net loss.

A net profit is a Credit in the Profit and loss account. Items on the Credit side of Profit and Loss Account. The expense side is greater than the credit side ie.

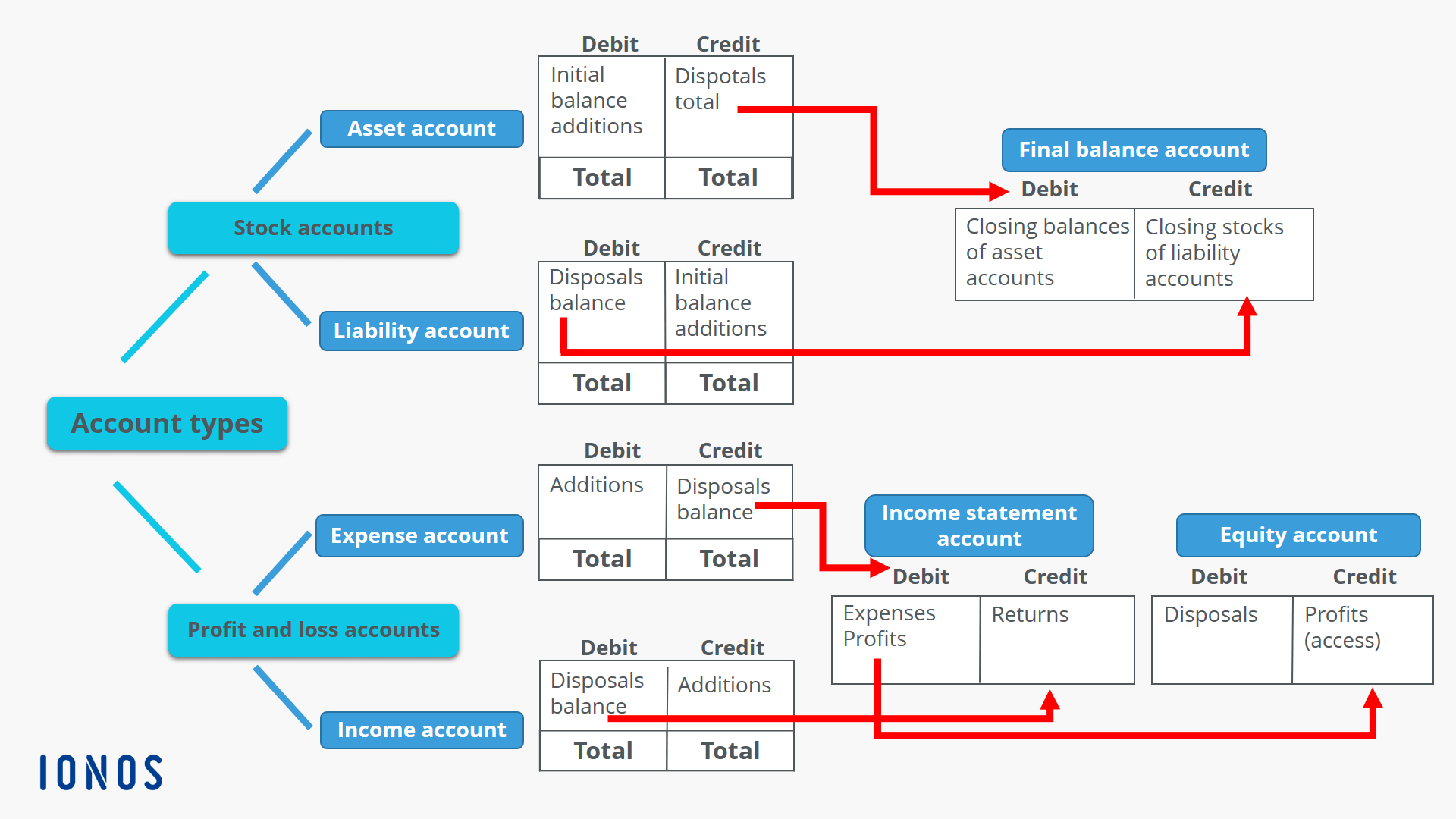

Account balancing also takes place for profit and loss accounts according to the principle of posting the balance of the opposite side of the account that is debit to credit. The net profit of the business firm is calculated by totaling the credit side and debit side of the Profit and Loss Account. The Profit and Loss Account of a business enterprise is prepared for an accounting period.

On the credit side. This value is obtained from the balance which is carried down from the Trading account. If credit side is more than the total of the debit side the difference between the two totals is the net profit.

To Gross profit bd. Refer to the image below. Under the double entry accounting convention income items in the Profit and loss account are Credits CR and expenses are Debits DR.