Unbelievable Incresae In Bank Indebtness Incresae Cash Flow

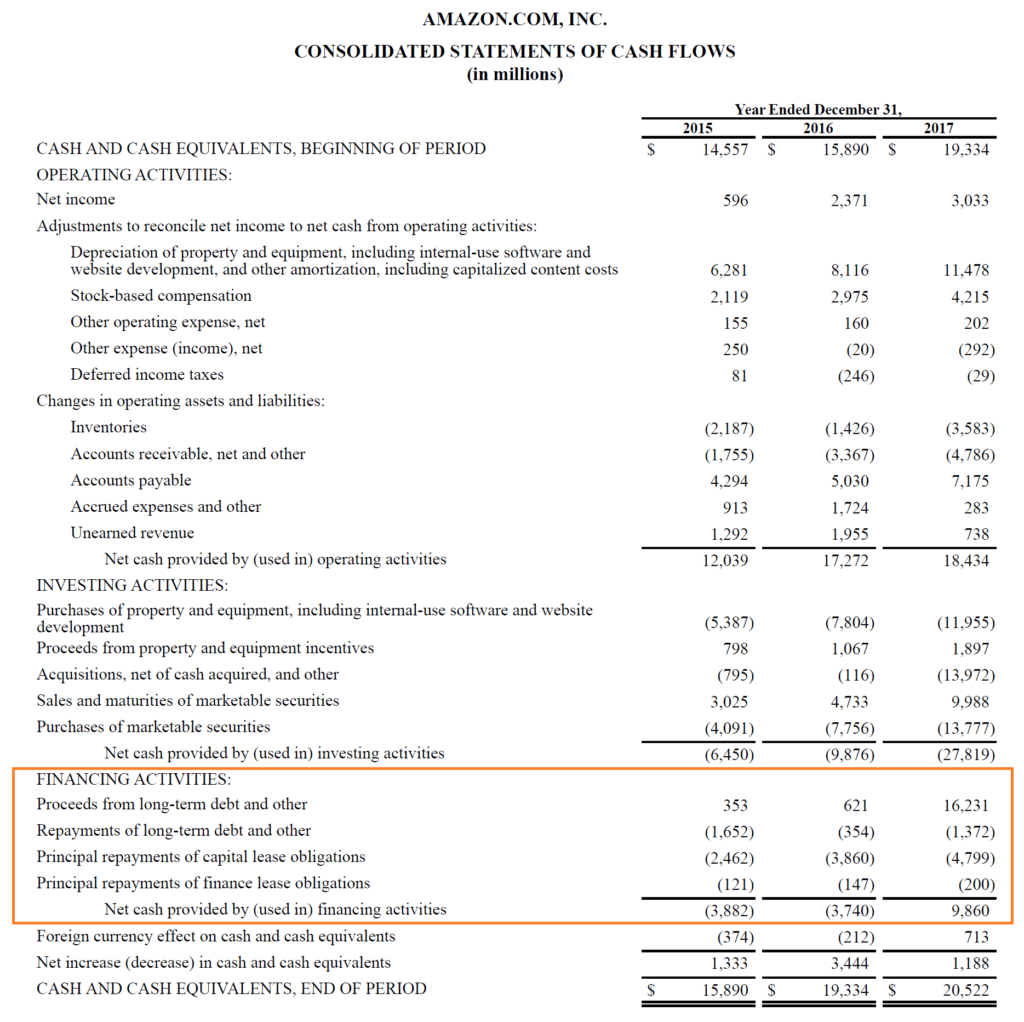

The repayment of the principal is included as a cash flow from financing activities because it is the same as the repayment of a debt.

Incresae in bank indebtness incresae cash flow. Advertiser Editorial Disclosure. Your mindset is what allows you to reduce. Calculating a companys net change in cash is as simple as finding three sometimes four entries on a cash flow statement.

Another option to increase cash flow is to take out a short-term loan or line of credit. Factoring is when you sell your accounts receivable to a factoring company for a slight discount and then let them take care of the collection of that invoice. The increase in accounts receivables is deducted from Net Profit and the decrease in accounts receivables is added to Net Profit.

Amount of increase decrease in cash cash equivalents and cash and cash equivalents restricted to withdrawal or usage. Take Out A Small Business Loan. Use these strategies to boost your cash balances and increase the rate of cash inflow.

If loans and borrowings increase during the period this means there has been an inflow of cash into the entity. With a short-term loan a lender gives you a lump sum of money that is paid back in regular installments over a short period of time. Ad Electronically Authorise Debit Order Collections Anywhere On Any Device.

Ad Electronically Authorise Debit Order Collections Anywhere On Any Device. This buying of time improves your cash flow. When a company purchases goods on account it does not immediately expend cash.

Since the purchase of additional inventory requires the use of cash it means there was an additional outflow of cash. If the loans or borrowings decrease this is due to a repayment which is an outflow of cash. The interest paid on short-term bank loans is included in the operating activities section of the statement of cash flows.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)