Formidable Accrued Revenues Would Normally Appear On The Balance Sheet As

Accrued Expense Meaning In accounting Accrued Expenses are expenses that have been incurred and for which the payment has not yet been made.

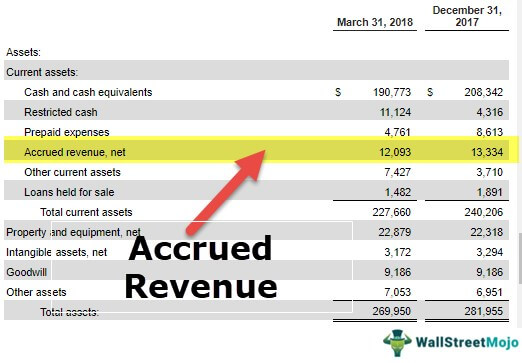

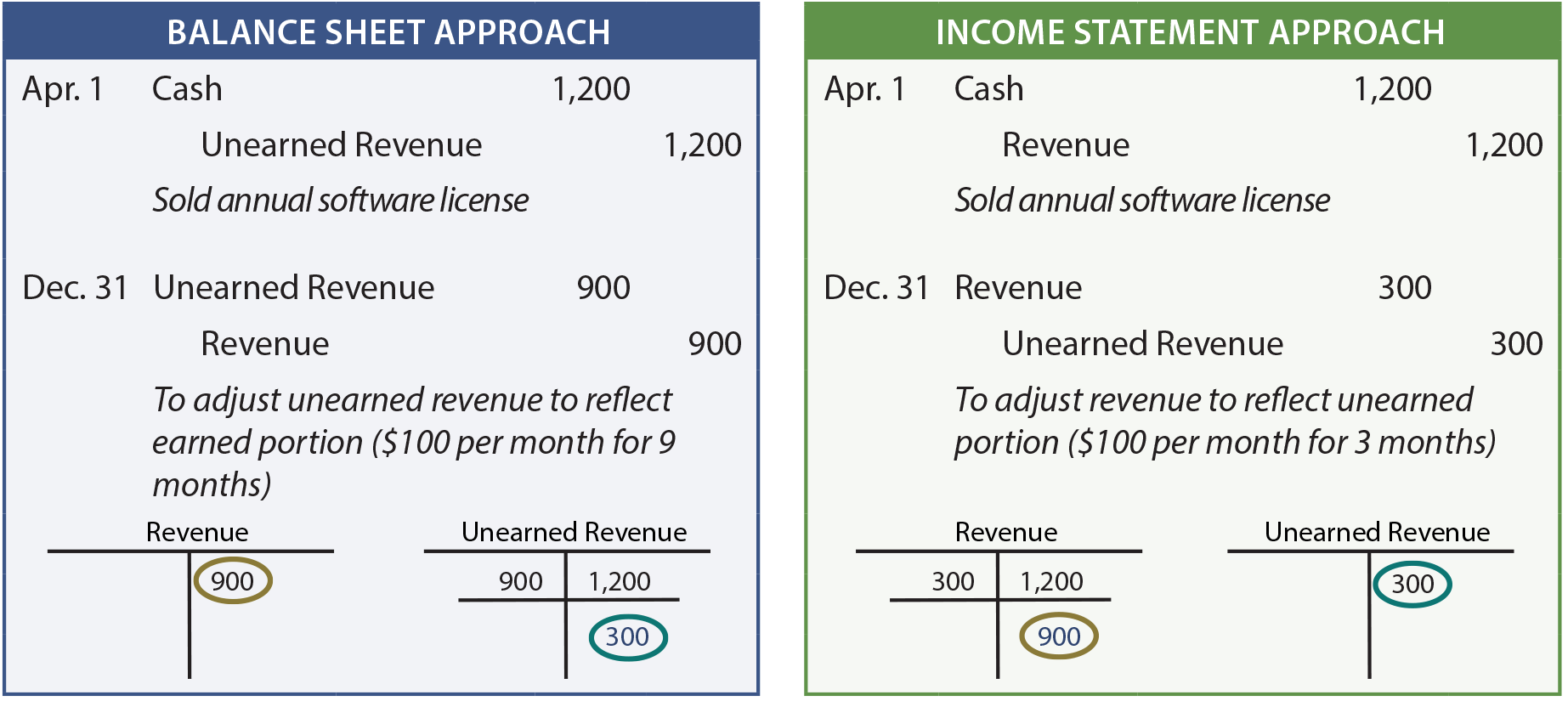

Accrued revenues would normally appear on the balance sheet as. Since it comes with the customers future obligation to pay an accrued revenue account on the balance sheet will appear when the related revenue is. Accrued revenues would normally appear on the balance sheet as a. Debit balances related to accrued revenue are recorded on the balance sheet while the revenue change appears in the income statement.

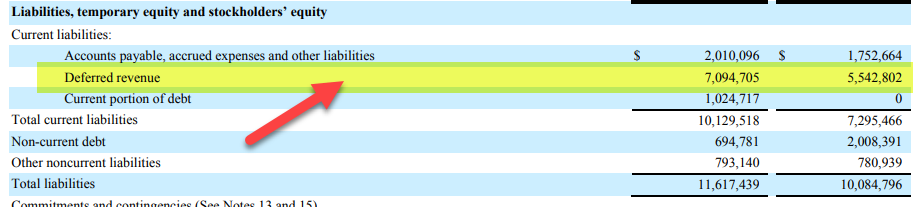

Having large amounts of accrued revenue can adversely impact the working capital cycle. When accrued revenue is initially recorded the amount of accrued revenue is recognized on the income statement as revenue and an associated accrued revenue account on the companys balance sheet. Accrued revenue is revenue that has been earned by providing a good or service but for which no cash has been received.

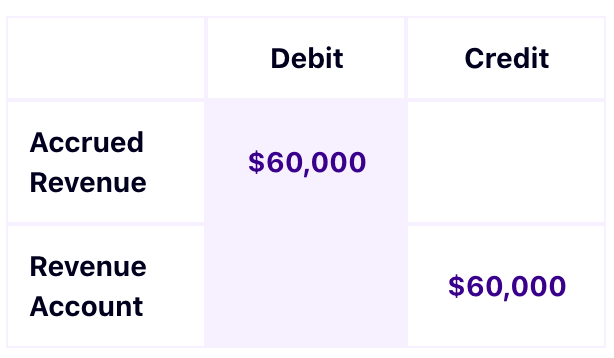

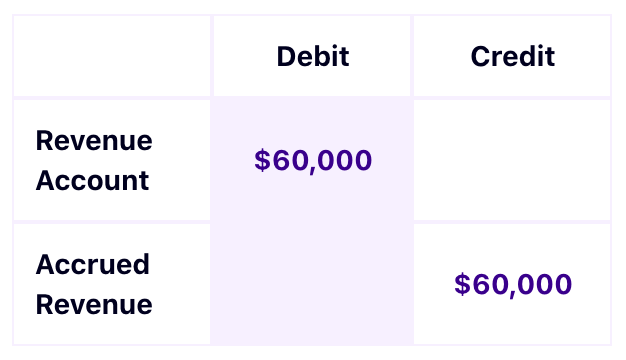

Accrued revenues would appear on the balance sheet as a. Which account would normally not require an adjusting entry. The accrual of revenues will usually involve an accrual adjusting entry that increases a.

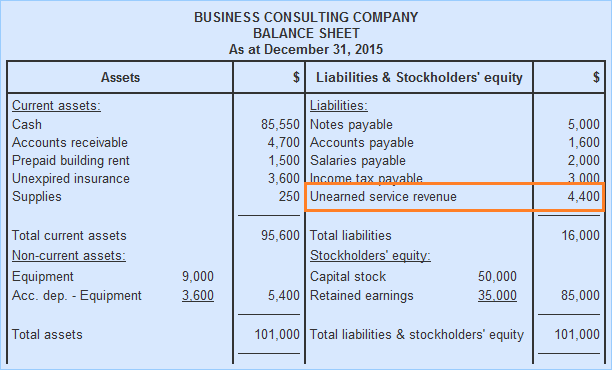

All adjusting entries have been made. Nonetheless accrued revenue is characterized as short-term and so would be recorded within the current assets section of the balance sheet. Once a company bills the customer for the goods provided or service rendered Accrued Revenue is treated as an Account Receivable until the customer pays the bill.

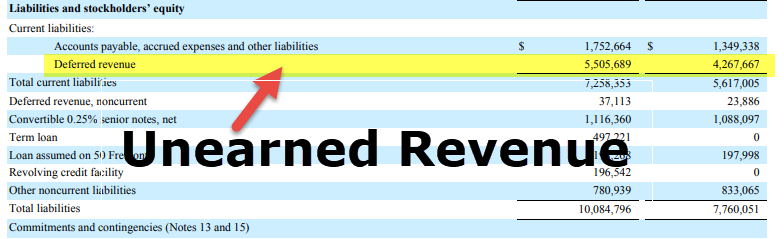

Therefore when you accrue an expense it appears in the current liabilities portion of the balance sheet. Accrued expenses are realized on the balance sheet at the end of a companys accounting period when they are recognized by adjusting journal entries in the companys ledger. Accrued Revenue is shown as an asset on the balance sheet but its not always as valuable an asset as liquid cash.

Is Accrued Revenue an Asset. Accrued expenses also called accrued liabilities are payments that a company is obligated to pay in the future for which goods and services have already been delivered. Accrual accounting requires revenues and expenses to be recorded in the accounting period that they are incurred.

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)