Impressive Journal Entry For Lawsuit Settlement Loss

No loss gets recognized by the borrower.

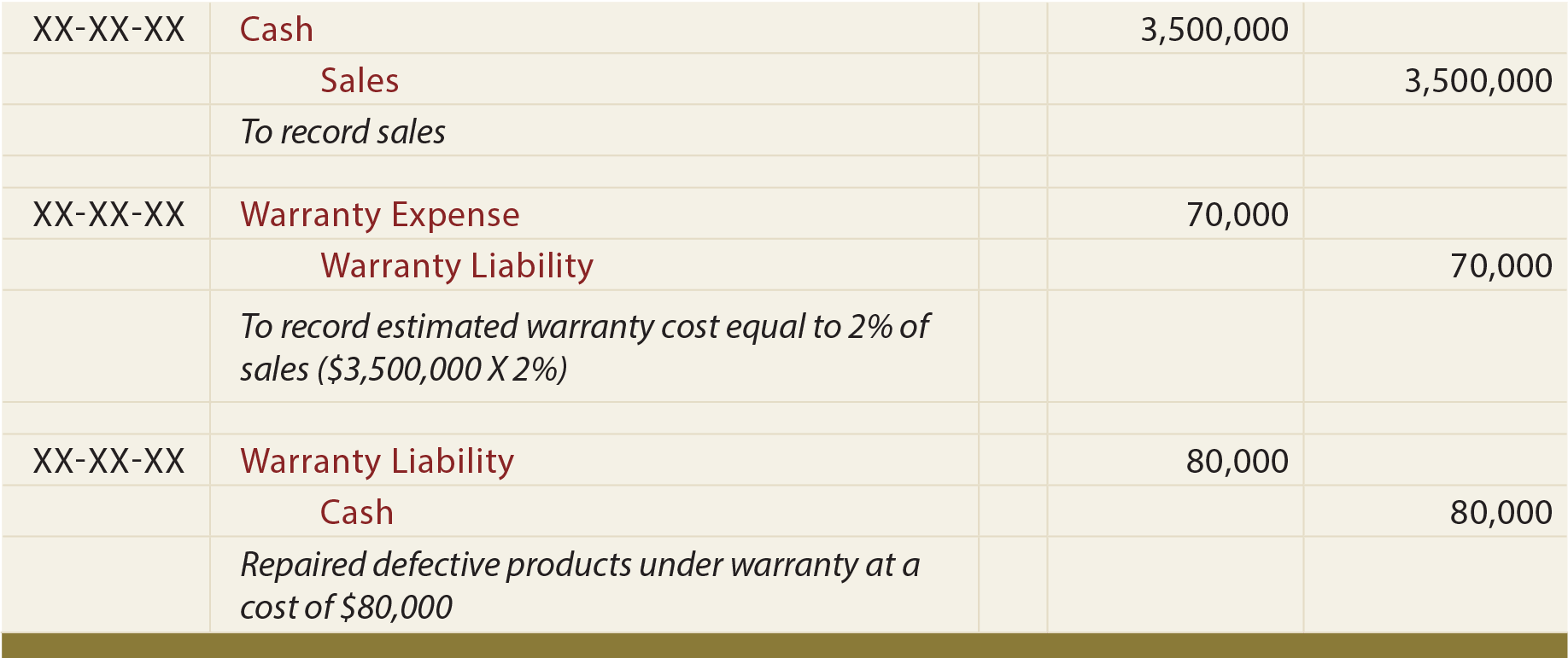

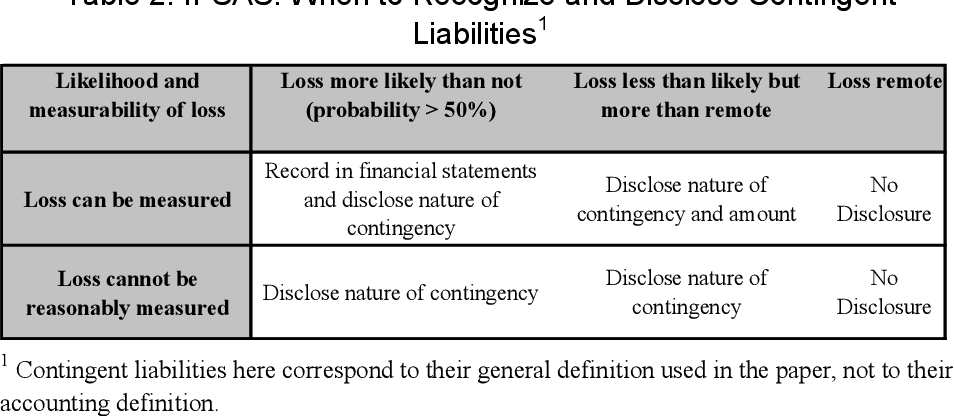

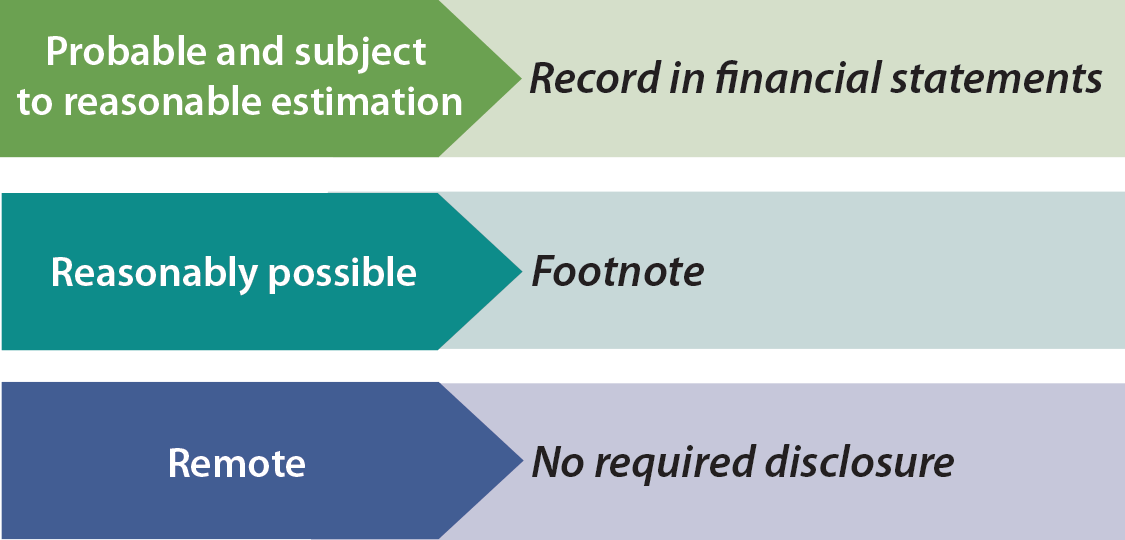

Journal entry for lawsuit settlement loss. The loss is not accrued because it is not probable that liability will arise soon. Some common example of contingent liability journal entry includes legal disputes insurance claims environmental contamination and even product warranties results in contingent claims. D Goods loss by fire Rs 50000 and insurance company accepted full claim.

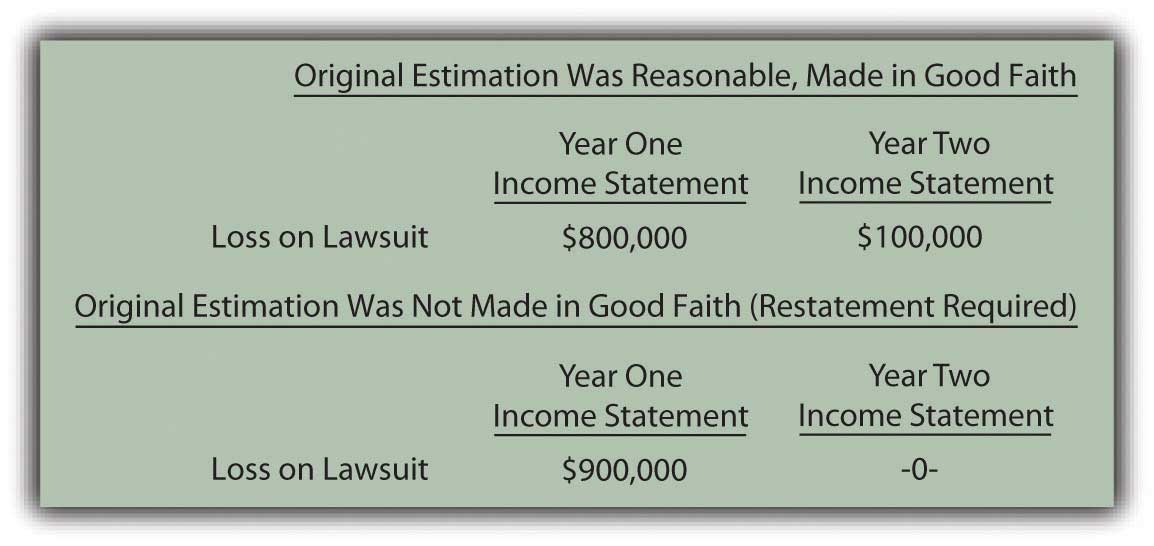

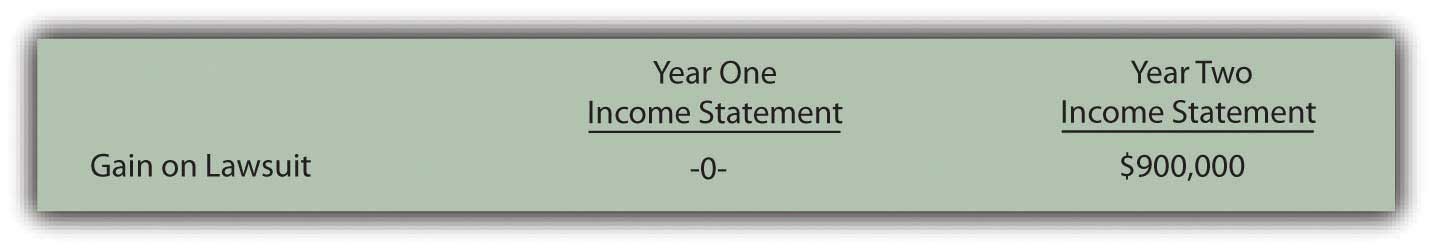

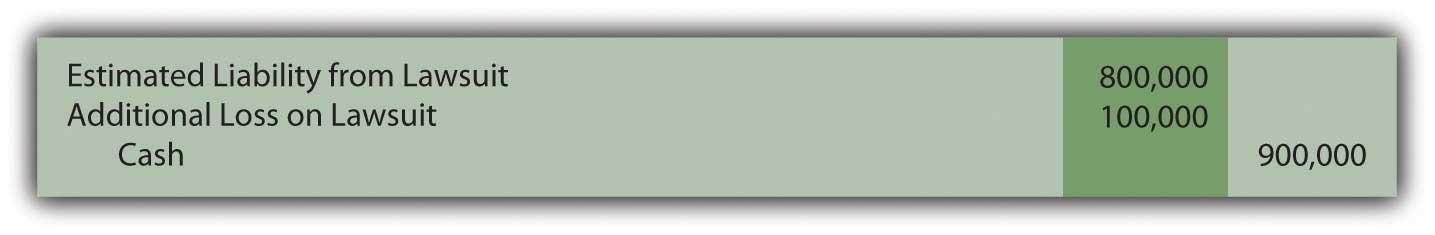

The journal entry would be. This means that the loss is likely to be shown earlier than the date that the payment is made. If the lawsuit is frivolous there may be no need for disclosure.

Journal entry against retained earnings. E Goods loss by fire Rs 60000 insurance company accepted only 60 claim. What the settlement provides.

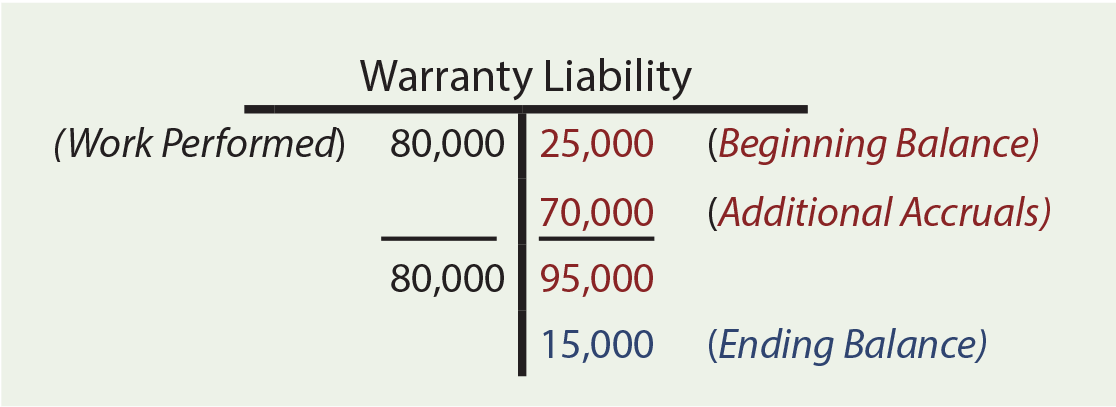

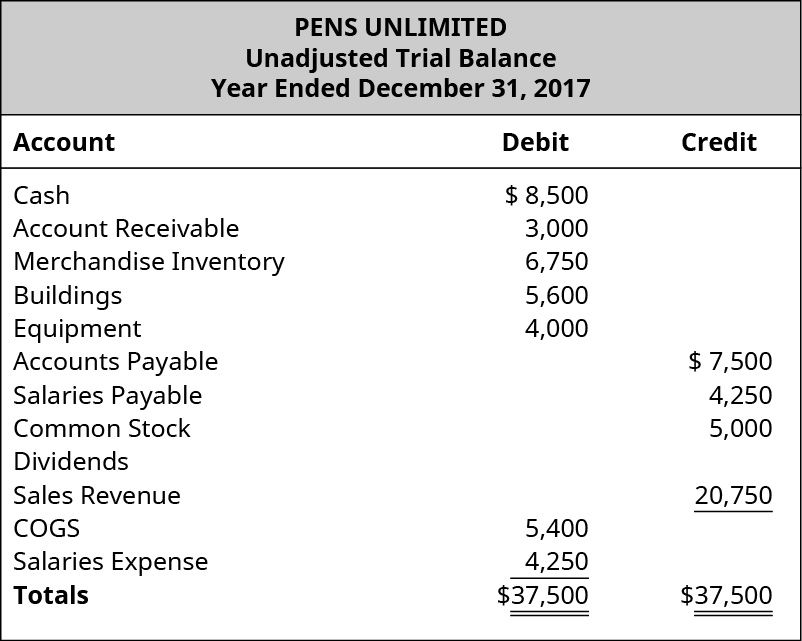

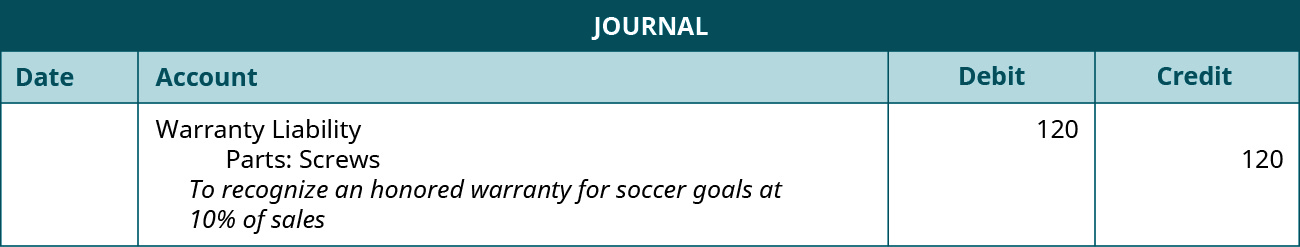

Write a journal entry to record the estimated loss. Trade discount is allowed at the time of credit sales. Accounting for Contingencies A contingency is an existing condition possibility of lawsuits of personal injury Guarantee and warranty costs Premium and coupons etc.

Borrowers either record a gain or adjust the interest rate. If the lawsuit isnt over but you think you might have to pay out its possible youll have to report the loss as a contingent liability. I need to know what the journal entry was for a settlement of free repairs in a class lawsuit by looking at the income statement.

Depending on your companys vacation policy earned but unused vacation time may be an accrued liability if specific criteria as determined by the Financial Accounting Standards Board FASB are met. Estimated liability from lawsuit 105B Retained earnings estimated loss 75B Accrued liability settlement 30B 4. When goods are sold on credit amount will be received after some days.

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)