Brilliant Tax Basis Balance Sheet Example

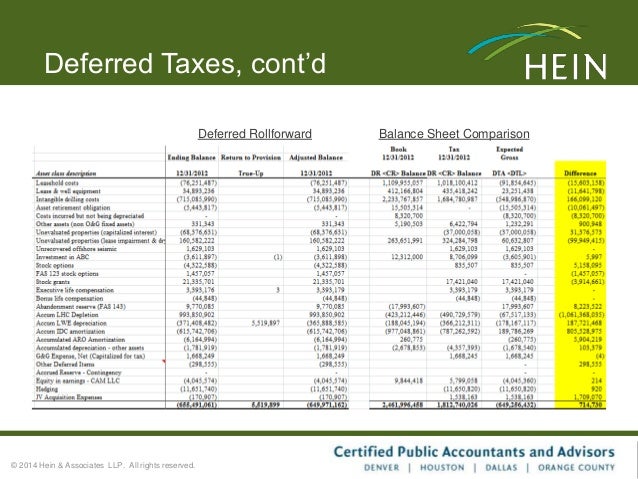

Compared to GAAP the income tax basis approach typically involves treatments that could make the reporting less complex.

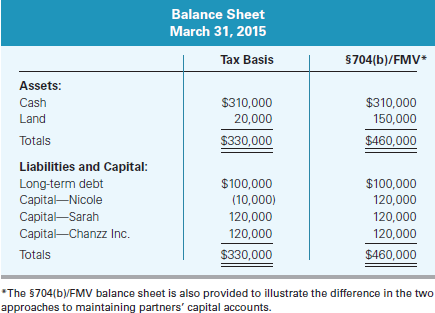

Tax basis balance sheet example. Realizing but not recognizing does not mean that you shouldnt show the life insurance proceeds on the tax-basis income statement. The second is suspended losses that are computed after the excess dividends. Balance sheet Simple Report on your assets and liabilities with this accessible balance sheet template.

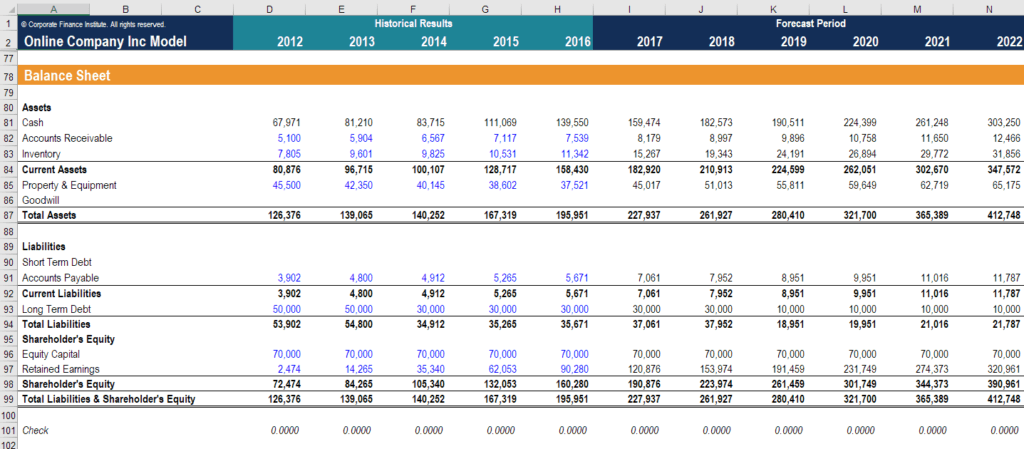

The tax basis balance sheet can be used to enter adjustments and the actual tax basis of assets liabilities based on the return as filed. TBClosing Trial Balance Closing BalanceAutomatically populated with the. How to Prepare a Tax-Basis Balance Sheet.

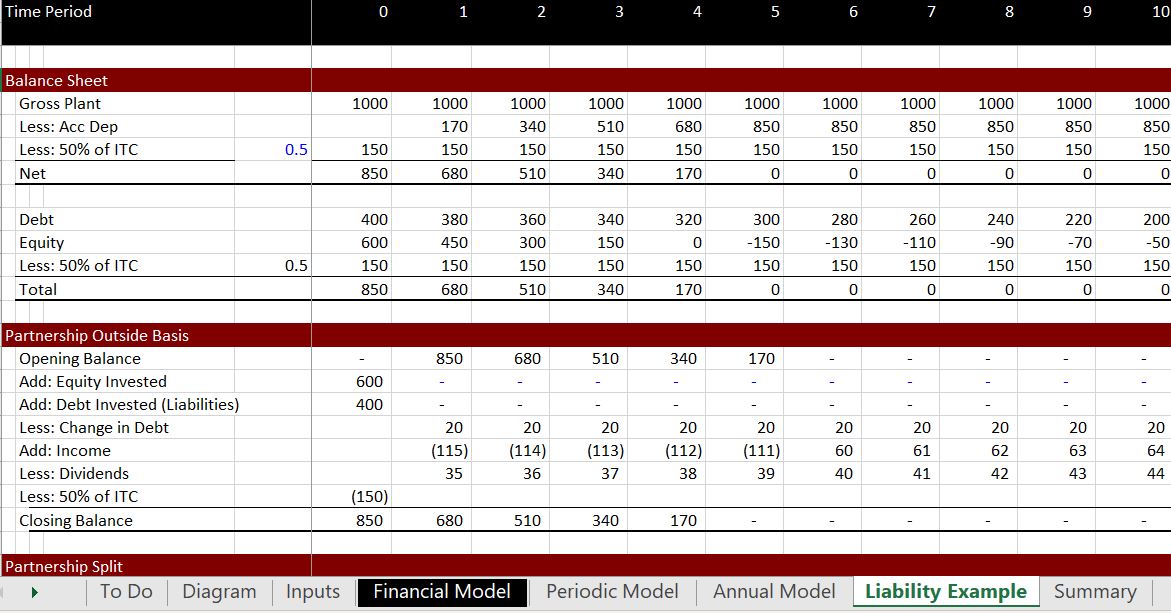

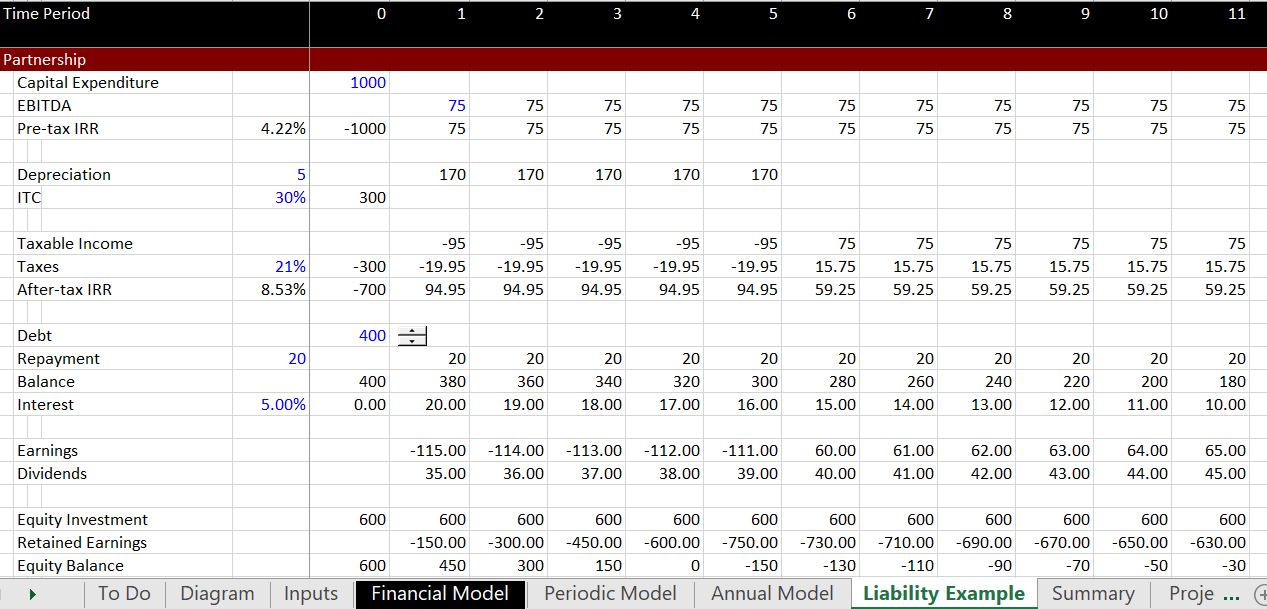

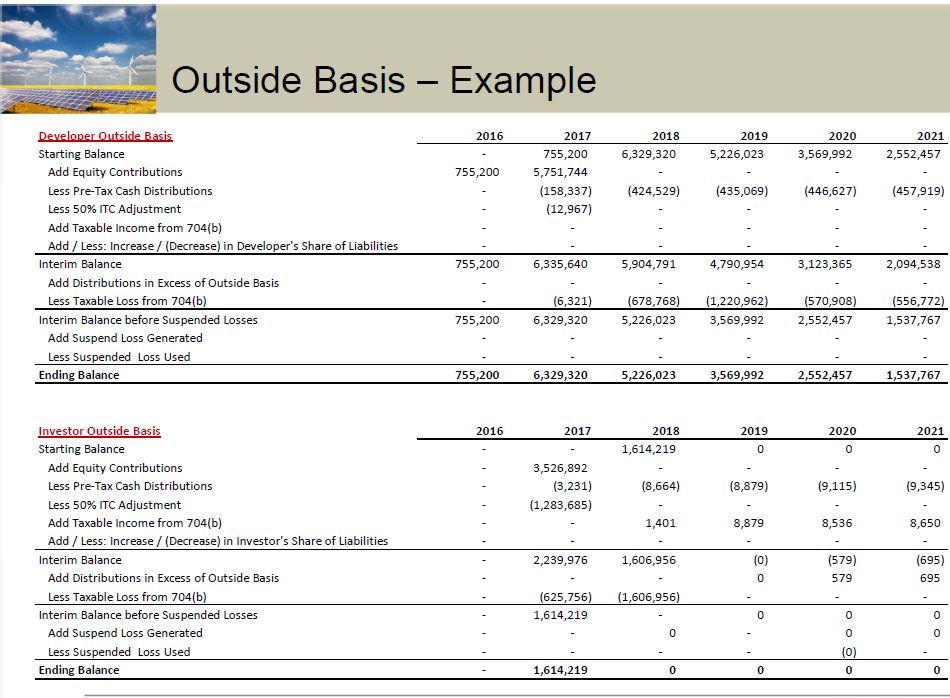

The balance sheet should balance. Contains the same information under cash basis modified cash basis and accrual basis accounting. If the partnership has nonrecourse debt then the partners share of this debt is added to his tax basis Both 704b capital account and tax basis go up by income allocated to the partner and down.

For example under the income tax basis of accounting. Description of the Tax Basis Balance Sheet columns based on the provided configuration. This is automatically populated from the balance sheet loaded in P12.

For instance a company may report on its balance sheet a fleet of 10 cars as assets worth 200000. Trial Balance Closing Balance. This example of a simple balance sheet.

However if the company bought the fleet five years ago the tax basis value will no longer be 200000. The Tax Basis Balance Sheet can be used to enter adjustments and the actual tax basis of assetsliabilities based on the return as filed. In this example Jerry spent 1000 for trade pub-.

/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)