Heartwarming Pso Financial Ratios

Pakistan State oil is the oil market leader in.

Pso financial ratios. 2011 has the highest EPS among the last 6 years Rupees. Profit and loss account analysis C4. Pearson PLC ADR balance sheet income statement cash flow earnings estimates ratio and margins.

- Interest cover ratio has improved due to increase in EBIT by 59. Business at a glance A2. Pearson Plc Common Stock PSO Nasdaq Listed.

Data is currently not available. It also blends and markets various kinds of lubricating oils. Financial statement analysis C1.

The EVEBITDA NTM ratio of Pakistan State Oil Co Ltd. CURRENT RATIO The current ratio determines the companys ability to pay back its short- term debts by using its short-term assets such as cash inventories and receivables. Is significantly lower than the average of its sector Integrated Oil Gas.

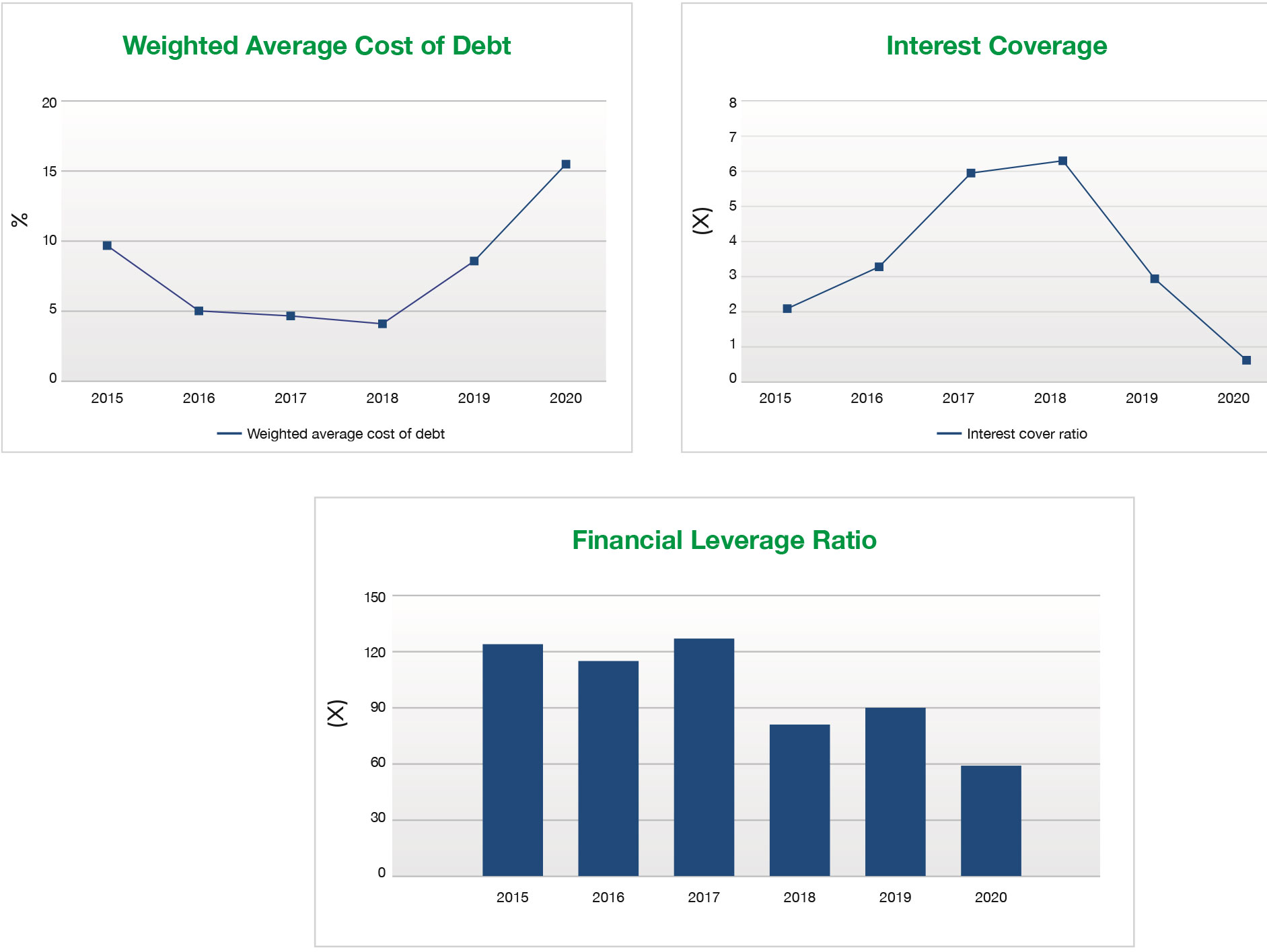

Ali Jahangir-19963 MObaid Ali Shah-18400 Umer Ali Khan-20656 PSO SHELL BYCO. Financial crisis 2009 D. Financial Leverage ratio x 117 028 095 059 044 089 Weighted Average Cost of Debt 1357 878 1062 1369 1116 1036 The variation in ratios as compared to FY 2013 is because of the following.

Pakistan State Oil Financial Analysis TABLE OF CONTENT A. - Operating gearing ratio financial leverage ratio have weakened due to increase in short term borrowings by 11 - Weighted average cost of debt has decreased due to increase in weighted average loan- balance by 76 vs increase in finance cost by only 16. Ten years of annual and quarterly financial statements and annual report data for Pearson PSO.