Wonderful Comparative Trial Balance Quickbooks

Quarterly Profit and Loss Summary.

Comparative trial balance quickbooks. The Trial Balance is. Ill send a message to the Product Development Team to let them know youd like to. If you dont see the option Enter comparative trial balance check that you havent previously indicated that this set of accounts is a first period.

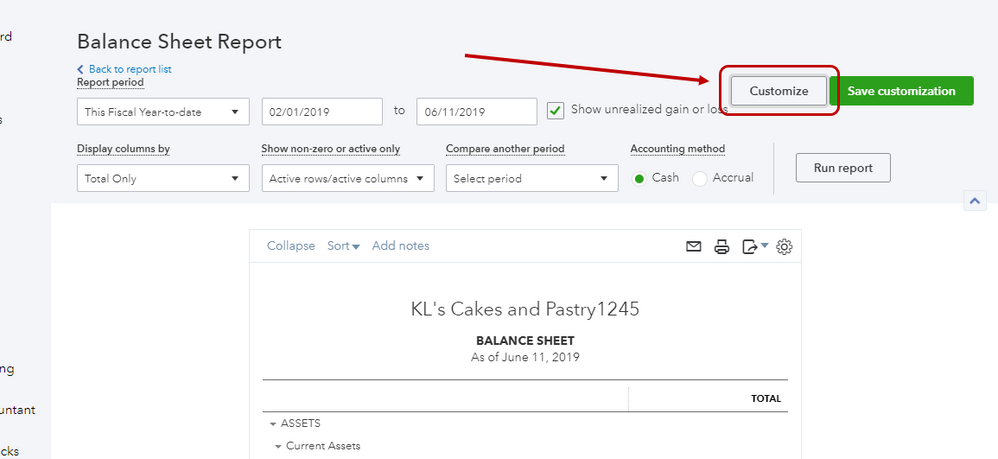

Profit and Loss year-to-date comparison. Using QuickBooks to Create Comparative Financial Statements. Combining Vertical and Horizontal Analyses.

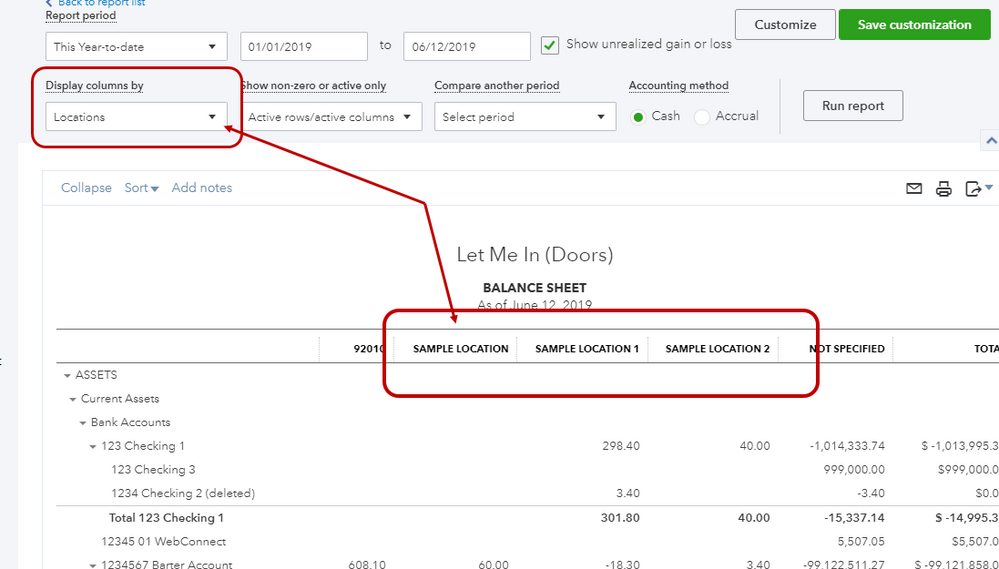

Click the Customize Report button select the correct dates and select either Cash or Accrual for your report basis. A row exists for every nominal account listed in ascending code order. Traditional Format but with Ability to roll up in ways not found in QuickBooks.

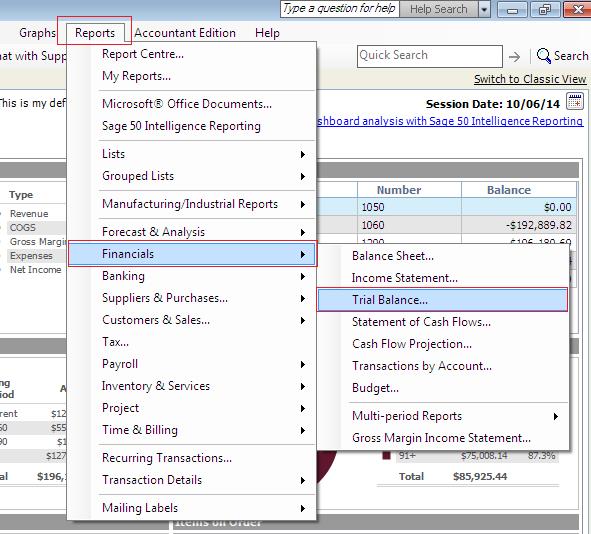

Sub Columns Previous year and change. The Trial Balance is a real-time report but the Reconciliation Detail report is a snapshot in time specifically the cleared and uncleared transactions at the time you did the reconciliation. Below is how to run the Comparative Trial Balance Reports.

Who owes you 6 reports. Chapter 1 touches briefly on the reasons you might want to use QuickBooks to prepare financial statements such as comparative balance sheets and comparative income statements. Join our 5 millions happy users.

Currently there isnt a function to download a trial balance report each month for comparison. To see one in QuickBooks go to the Reports menu and select Accountant Taxes Trial Balance. Profit and Loss by Month.