Divine Profit And Loss Adjustment Account Format

In case of profit.

Profit and loss adjustment account format. In case of loss. If the subsidiary company has passed entries for proposed dividend and the holding company has also taken credit for its share of the dividends there will be a cancellation from both sides of the Consolidated Profit and Loss Account. To Profit and loss account ac Being the accounts of all the incomes closed 3.

There is no prescribed format. The adjustment is the process of adjustment of expenditure and income outstanding and prepaid depreciation of goods bad debt interest on capital and drawings etc in the final accounts. This account is also prepared in T-form.

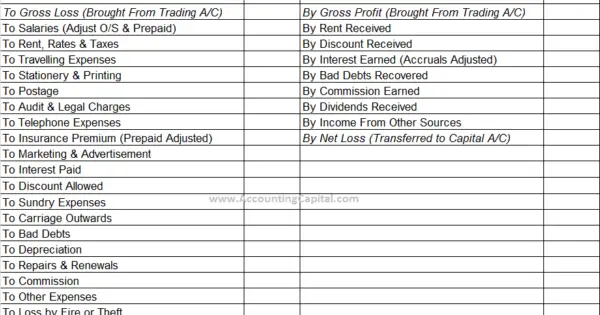

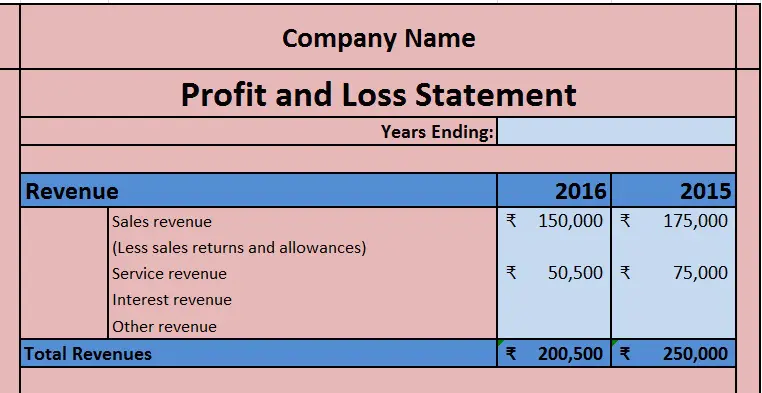

For calculating funds from operations any one of the following formats may be used. Profit and loss account is the statement which shows all indirect expenses incurred and indirect revenue earned during the particular period. 3 Profit and Loss.

Profit and loss account ac. 3 All items internal to the holding and subsidiary companies should be eliminated. Here it is very necessary to remember that these accounts are not prepared in the ledger rather than on the plain sheets or papers.

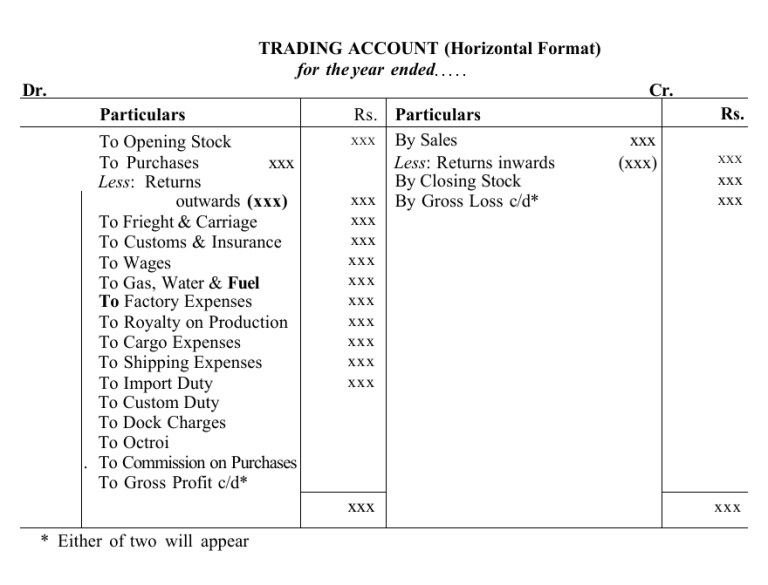

Timing Trading Account is prepared first and then profit and loss account is prepared. Incomes Ac individually Dr. The Profit and Loss Account of a banking company must be prepared as per Form B of the Act in vertical form like Balance Sheet.

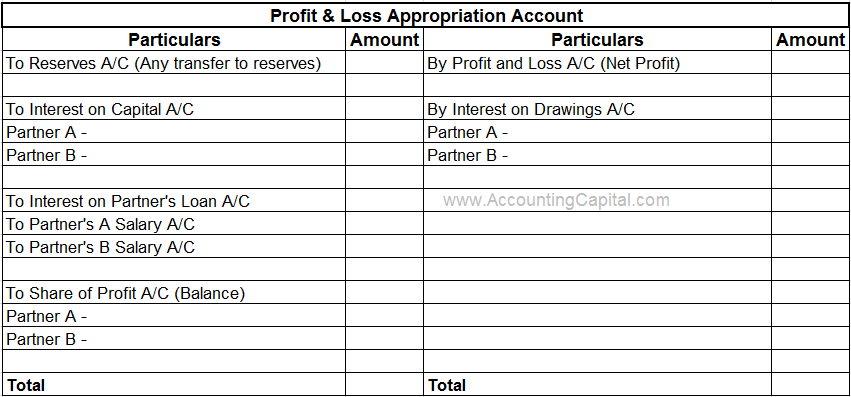

This is an extension of usual Profit and Loss Account for the purpose of adjusting transactions relating to Partnership Deed. PROFIT AND LOSS ACCOUNT was renamed as STATEMENT OF PROFIT AND LOSS. ProfitLoss Account is prepared after the trading account is prepared.