Glory Schedule Vi Of Companies Act 2013 Format

The revised Schedule VI will apply to all the companies uniformly for the financial statements to be prepared for the financial year 2010-11 and onwards.

Schedule vi of companies act 2013 format. Thus a company will not have option to use horizontal format for presentation of financial statements. No change in the format of Cash Flow Statement as per schedule VI. 19 section 50 or 54 of the Banking Act as applied by section 55ZJ of that Act section 467 of the Credit Bureau Act 2016 section 47 of the Finance Companies Act Cap.

It provides that a company engaged in the setting up of and dealing with infrastructural projects may issue preference shares for a period exceeding twenty years but not exceeding thirty years subject to the redemption of a minimum ten percent of such. Issued the Guidance Note on Revised Schedule VI to the Companies Act 1956 in January 2012. Name of the Issuer We the debenture trustees to the above mentioned forthcoming issue state as follows.

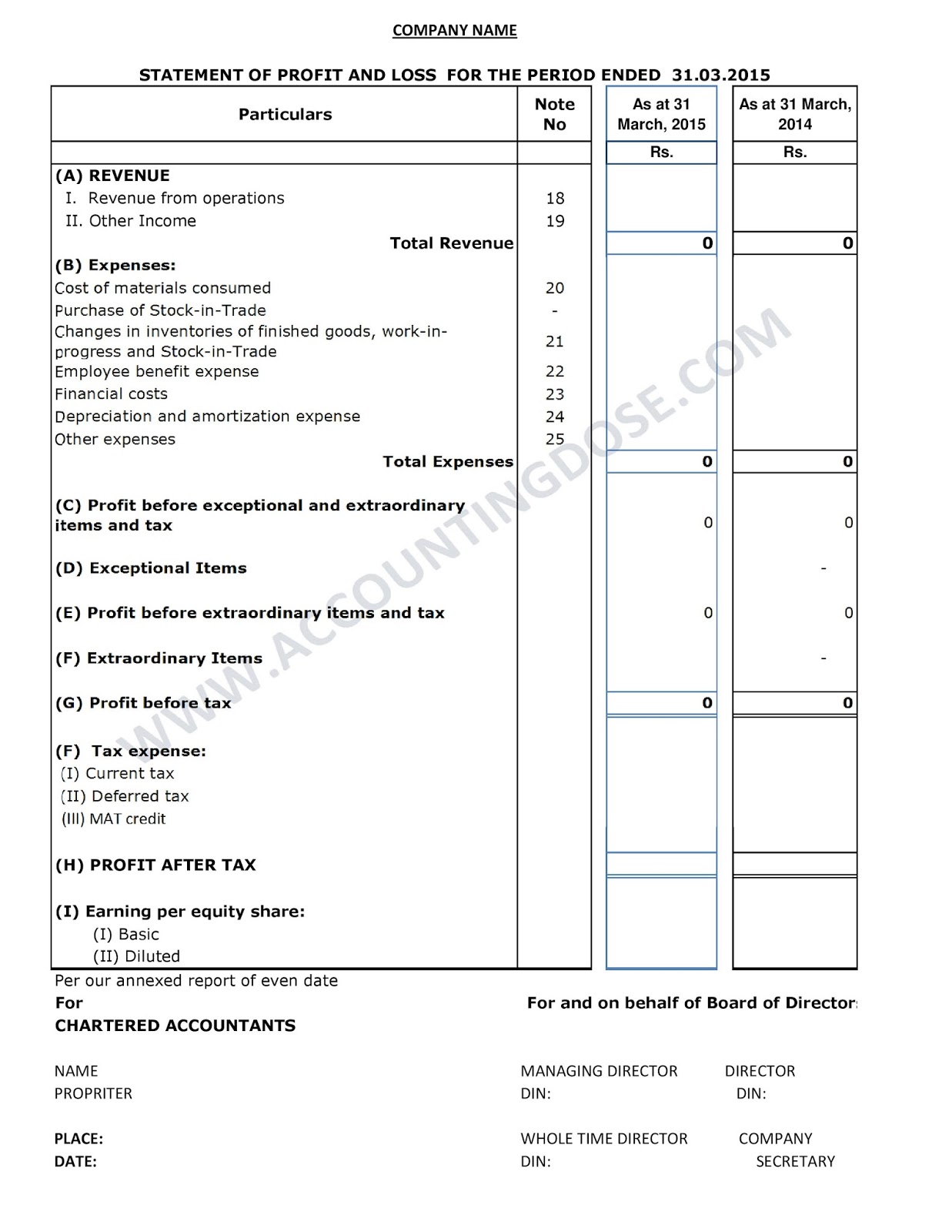

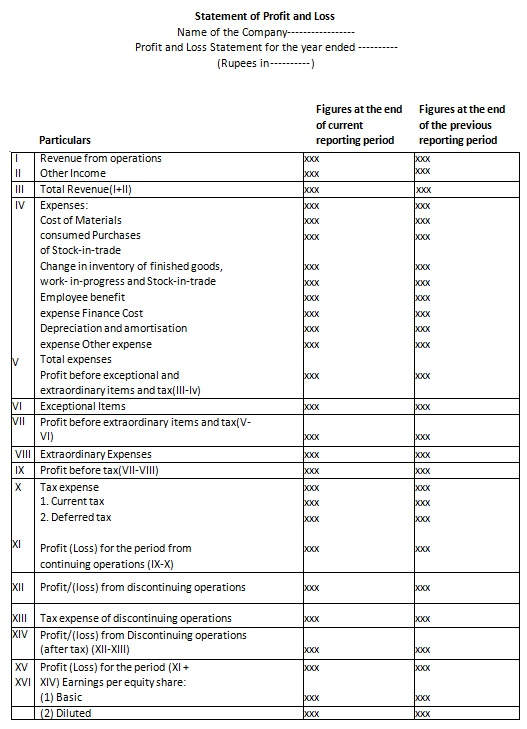

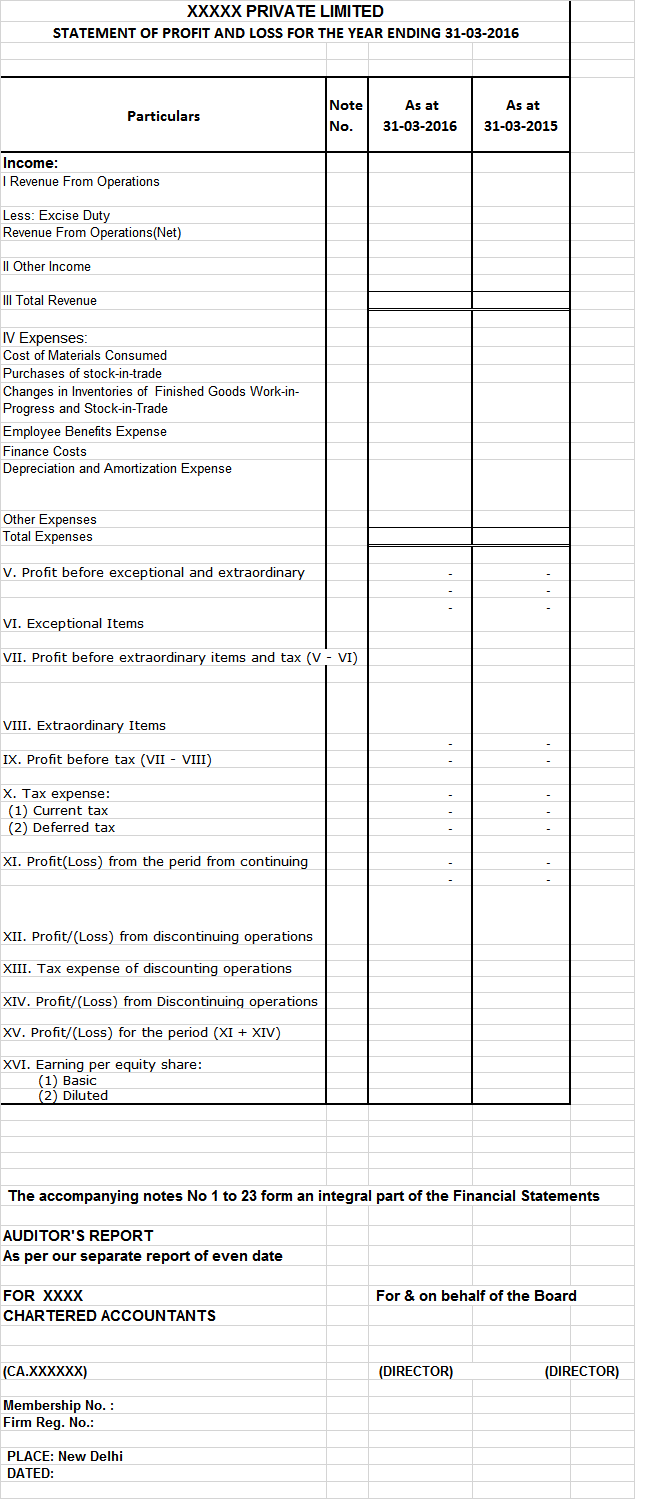

36 rows Chapter III Part - II The Companies Private Placement Section 42. This format of Statement of Profit and Loss does not mention any appropriation item on its face. Revised Schedule VI Format with Automatic Formulas.

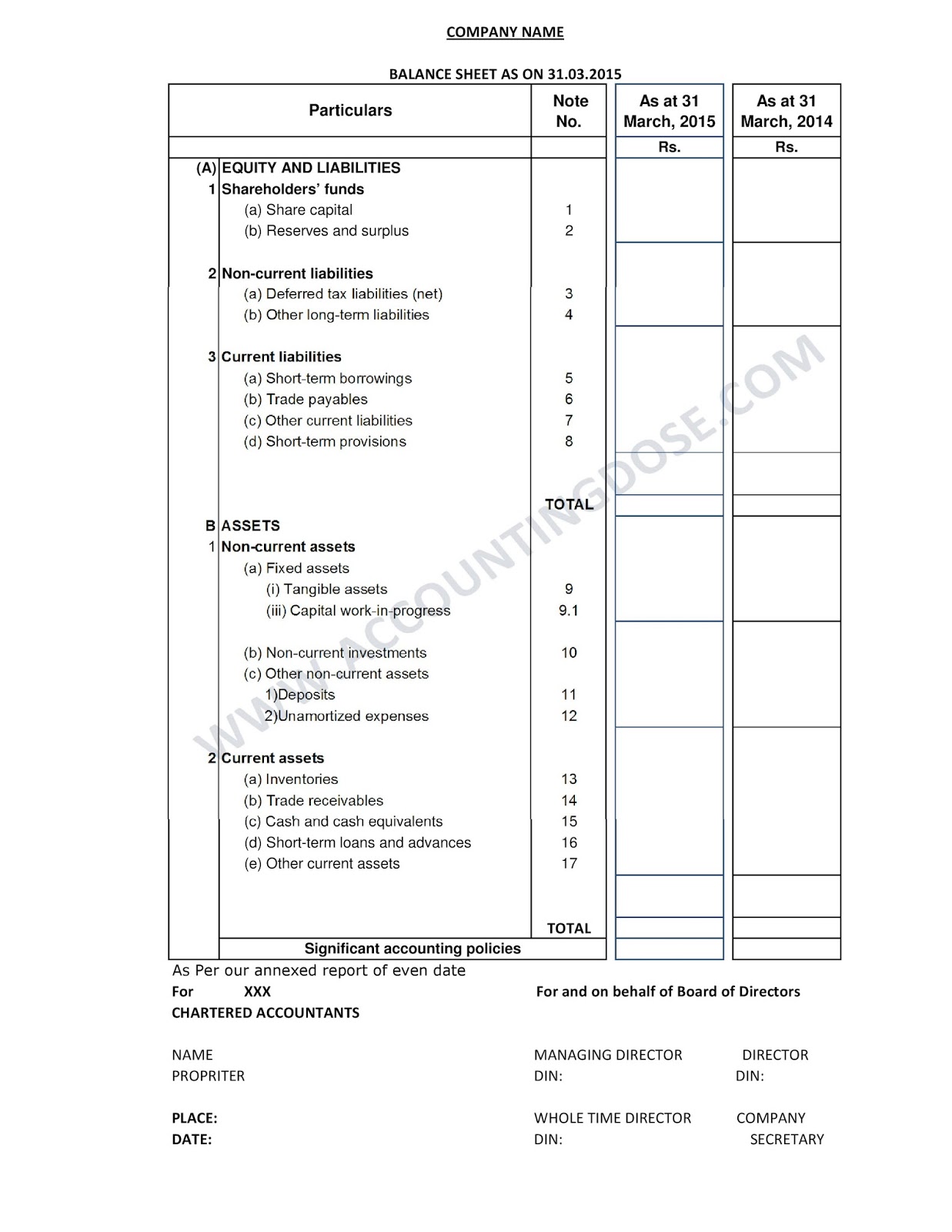

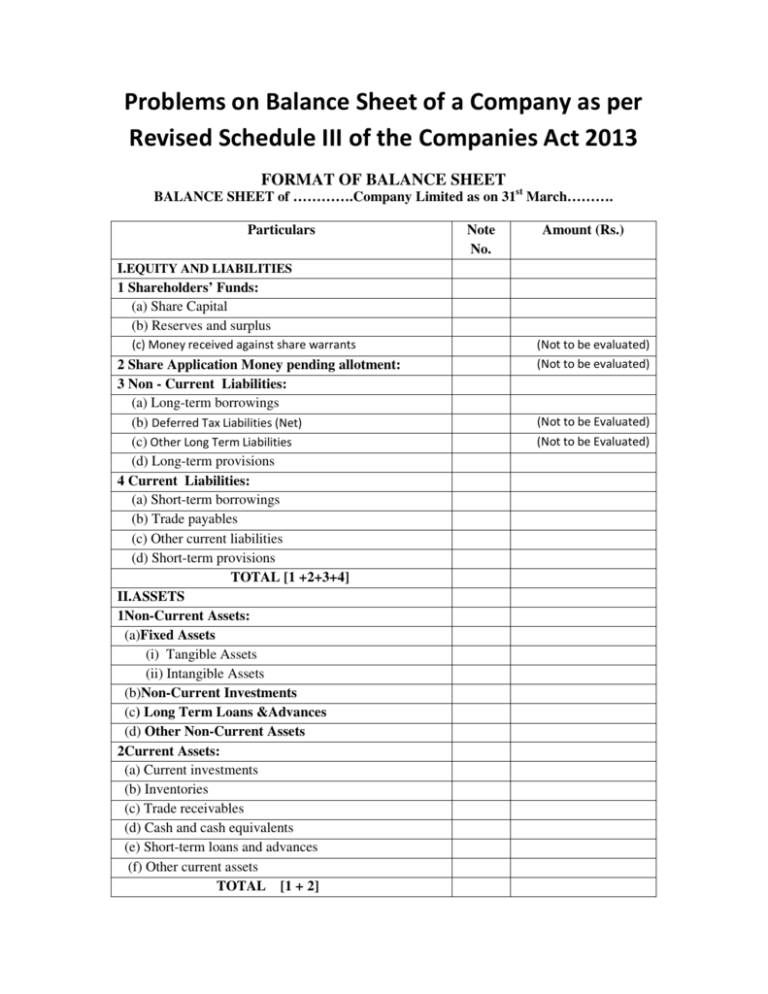

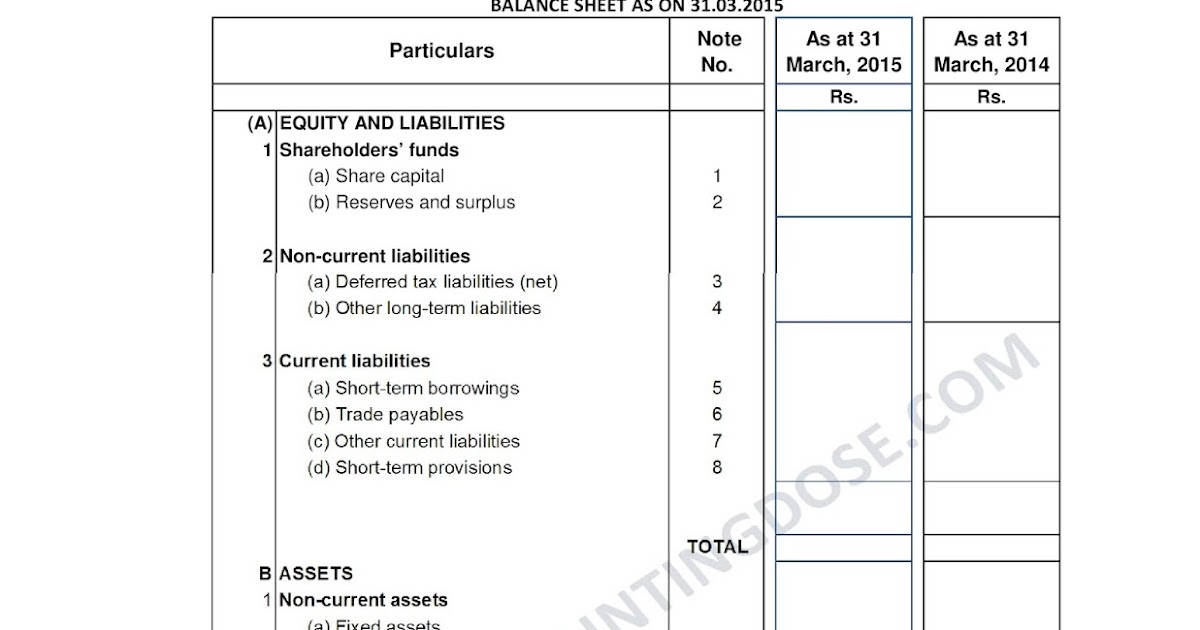

Other loans and advances Note ii Disclosure pursuant to Note no. The text of the revised Schedule VI is available at httpwwwmcagovin. Format of Balance Sheet as per Schedule VI to the Companies Act-1956 The vertical format of Financial Statement as per SCHEDULE VI.

Except for addition of general instructions for preparation of Consolidated Financial Statements CFS the format of financial statements given in the Companies Act 2013 is the same as the revised Schedule VI notified under the Companies Act 1956. Unlike the Old Schedule VI the Revised Schedule VI lays down a format for the presentation of Statement of Profit and Loss. Revised Schedule VI prescribes a vertical format for presentation of balance sheet.

Chapter VI Registration of Charges. Schedule iii provides a format of the balance sheet and sets out the minimum requirements of disclosure on the face of the balance sheet items presented in the balance sheet are to be classified as current and non current. This will definitely improve the usefulness of the balance sheet.