Peerless Schedule Vi Of Companies Act, 2013

Schedule VI does not contain any specific disclosure for items included in Old Schedule VI under the head Miscellaneous Expenditure.

Schedule vi of companies act, 2013. 1 Subject to any leave which the Court may give pursuant to an application under subsection 3 a person who is subject to a disqualification or disqualification order under section 56 57 58 59 or 60 of the VCC Act must not act as director of or in any way whether directly or indirectly take part in or be concerned in the management of any company or any foreign company to which Division 2 of Part. It provides that a company engaged in the setting up of and dealing with infrastructural projects may issue preference shares for a period exceeding twenty years but not exceeding thirty years subject to the redemption of a minimum ten percent of such preference shares per year from the twenty first year onwards or earlier on proportionate basis at the option of the preference shareholders. As per Part C of Schedule II of The Companies Act 2013 iv 1 Towers 18 Years 528 1533 2 Telecom transceivers switching centres transmission and other network equipment 13 Years 731 2058 3 Telecom - Ducts Cables and optical fibre 18 Years 528 1533 4 Satellites 18 Years 528 1533 v 1 Refineries 25 Years 380 1129.

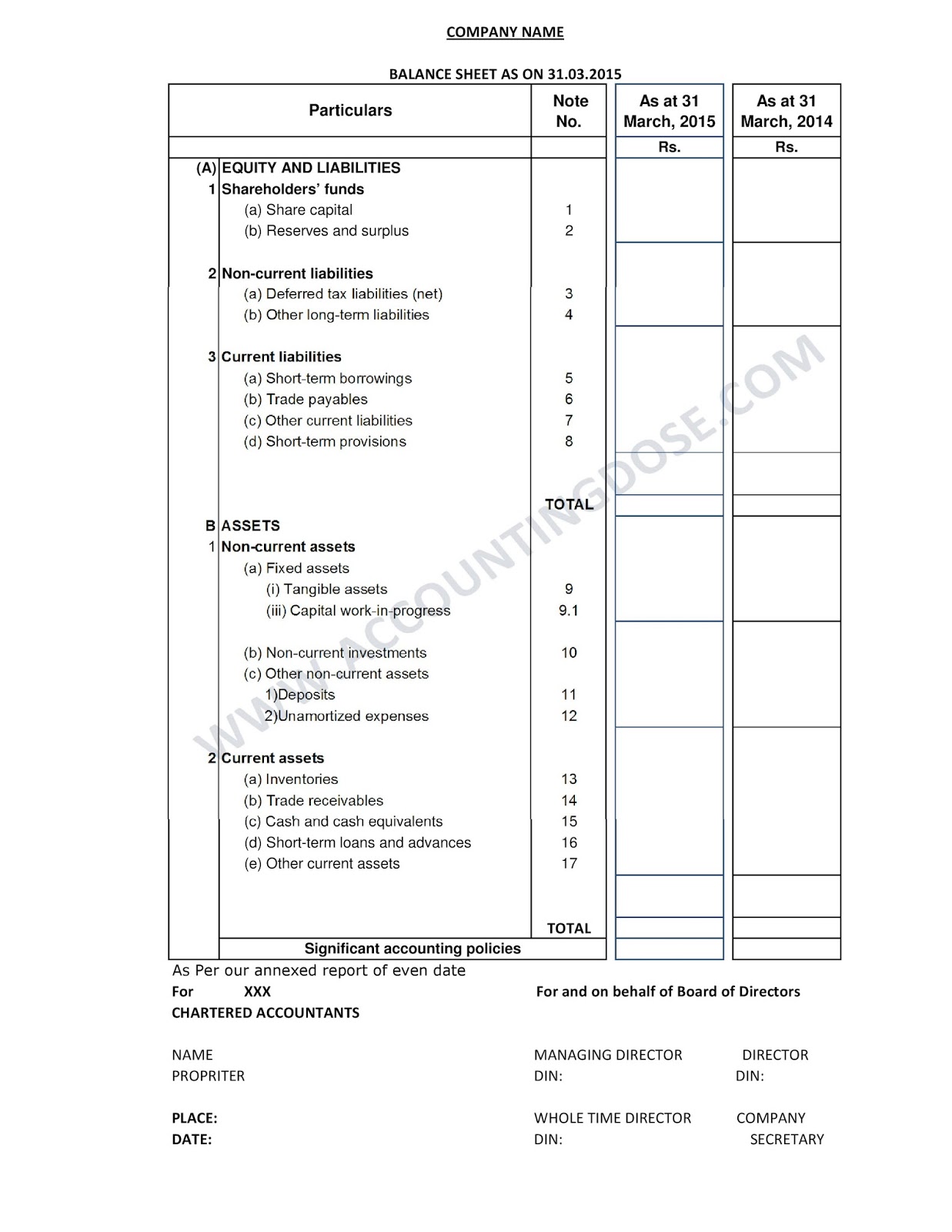

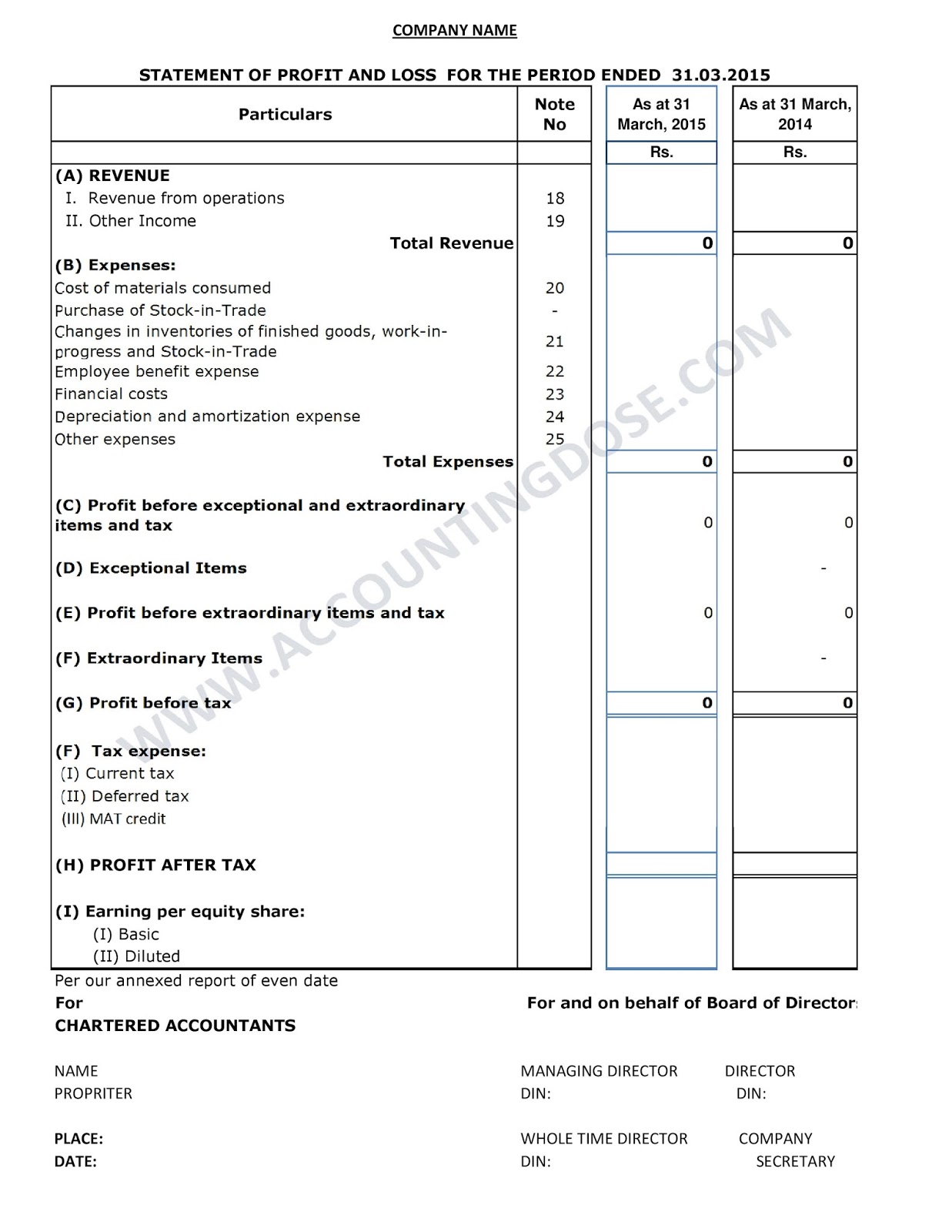

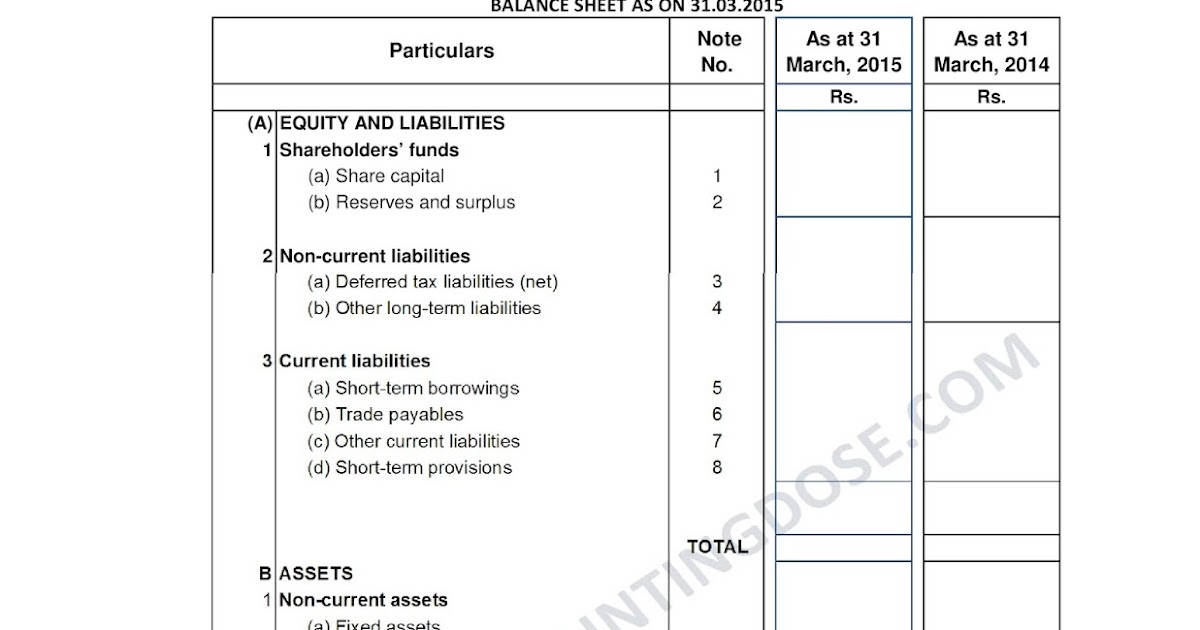

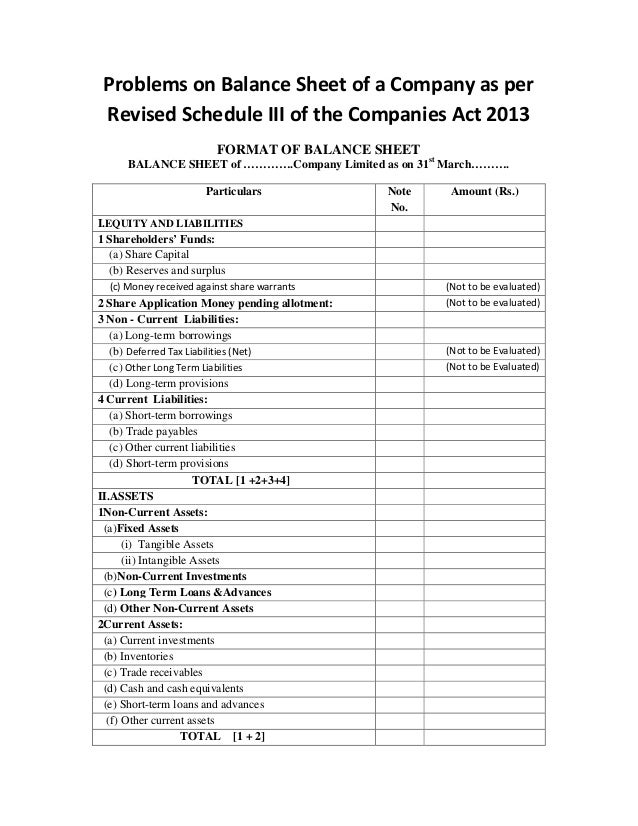

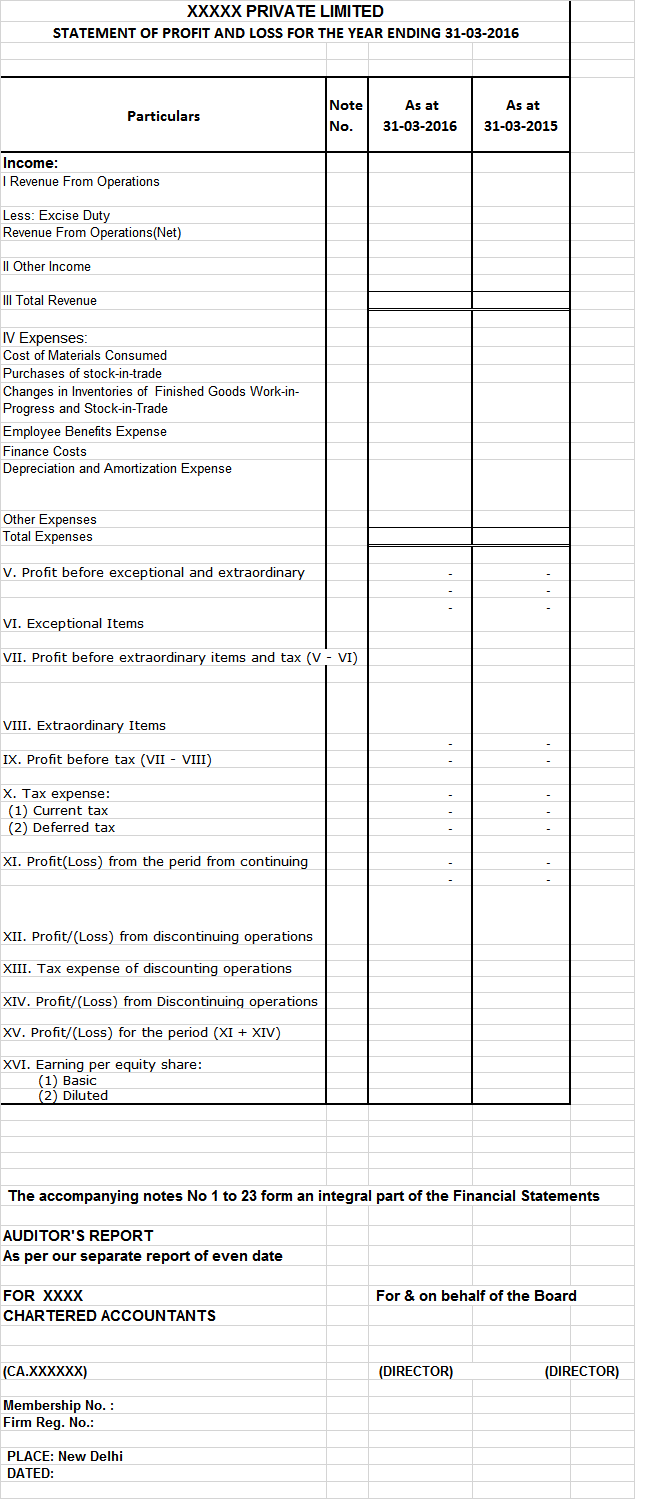

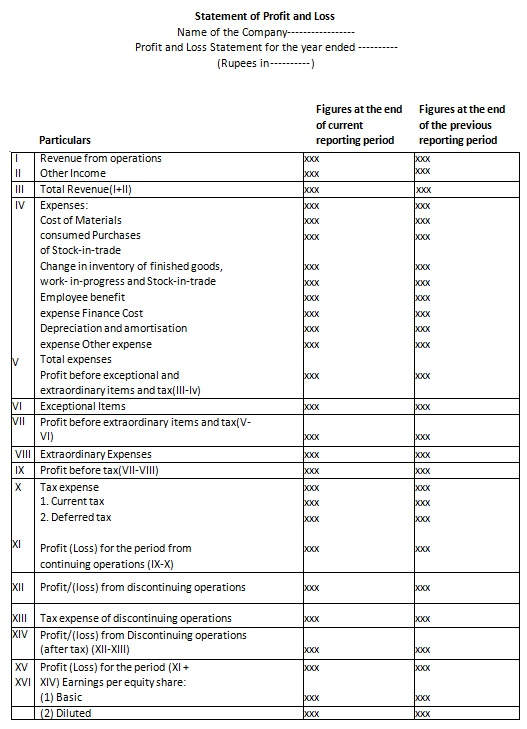

The draft of the revised schedule VI is available at the web site of the Ministry of Corporate Affairs httpwwwmcagovin. Why do we need to follow Schedule VI the answer is Section 211 of the Companies ActSub section 1 of section 211 makes it mandatory for a company to provide its Balance Sheet in the form set out in Part I of Schedule VI and Sub Section 2 mandates to comply with the requirements of Part II of Schedule VI in drawing up its profit and loss account. Except for addition of general instructions for preparation of Consolidated Financial Statements CFS the format of financial statements given in the Companies Act 2013 is the same as the revised Schedule VI notified under the Companies Act 1956.

As per Schedule II of Companies Act 2013 The description of Fixed assets has been more detailed to short out the problem of rates of charging depreciation and the maximum life of assets has been provided so that the Financial statement can provided a true and fair view. See sections 55 and 186 The term infrastructural projects or infrastructural facilities includes the following projects or activities. As per AS-16 borrowing cost and discount or premium relating to borrowing could be amortized over loan period.

1 This is to certify that the red herring prospectus in case of a book built issue prospectus in case of a fixed price issue registered with the Registrar of Companies letter of offer filed with the designated stock exchange in case of a rights issue on. 2013 Act now allows one person to form a company vis-à- vis the earlier position where a minimum of two persons were required to form a company private. As per Part C of Schedule II of The Companies Act 2013 Nature of Assets Useful Life Rate SLM Rate WDV viii Plant and Machinery used in manufacture of non ferrous metals 1 Metal pot line NESD 2 Bauxite crushing and grinding section 3 Digester Section NESD 4 Turbine NESD 5 Equipments for Calcinations NESD.

This new concept will be beneficial as entrepreneurs will be able to singly set up a corporate entity restrict the liability of business and reduce compliances. The extant schedule VI does not require companies to classify assets and liabilities into current and non-current categories. See Section 135 Activities which may be included by companies in their Corporate Social Responsibility Policies Activities relating to.

36 rows Chapter III Part - II The Companies Private Placement Section 42. In exercise of the powers conferred by Sub-section 3 of Section I of the Companies Act 2013 18 of 2013 the Central Government hereby appoints the 1st day of April 2014 as the date on which the. As per the Act and rules notifications thereunder.