Recommendation Tax Basis Balance Sheet Template

Sort sheet by column A A Z.

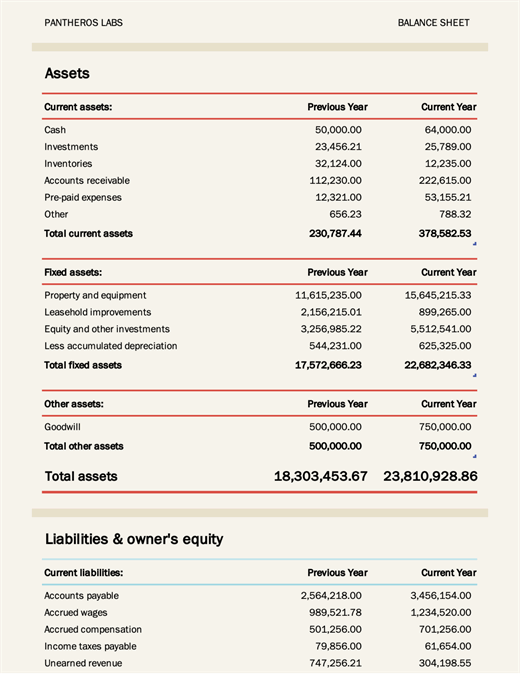

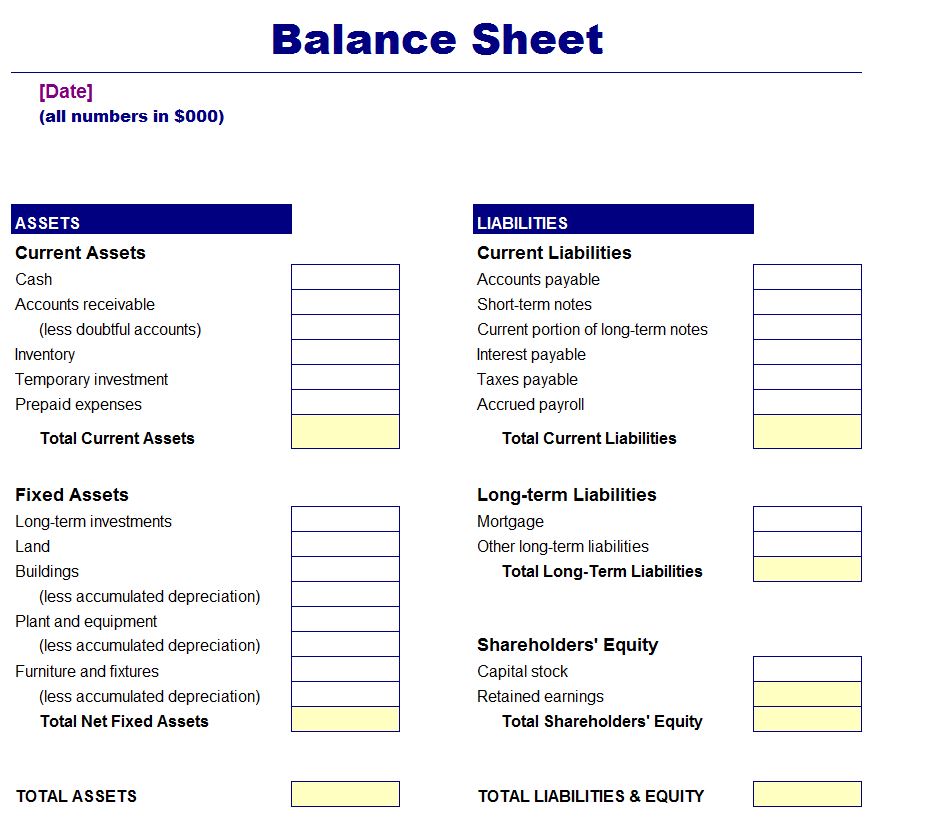

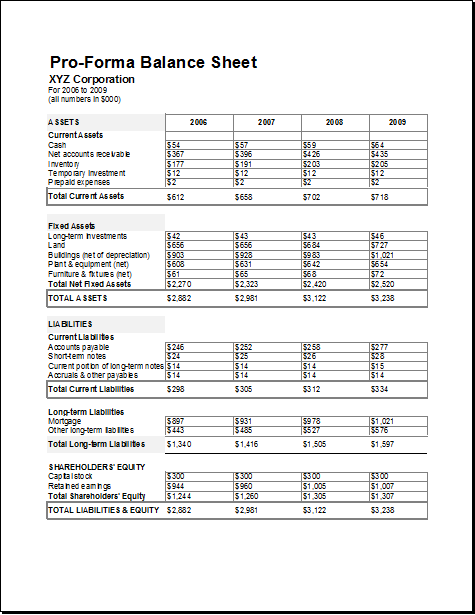

Tax basis balance sheet template. Tax Basis BS Preliminary. In order to save time and effort many entities may opt to use balance sheet templates for this purpose. In a tax basis balance sheet the liabilities of a.

5 For the list of selected industries please refer to IRAS website at wwwirasgovsg Businesses Self Employed Sole. This assurance provides a business with comfort that its tax accounts and accompanying financial statements are correct. Current Year Tax Data Book Accounts.

A deposit slip is a piece of paper that is used by the banks customers to deposit funds or amounts into their bank. Text r otation. A balance sheet is a summary of the financial balances of an entitywhether the entity is a sole proprietorship a partnership business any corporation or any other organisation such as a Government or a Not for Profit Organisation.

Armed with your transaction records and the tax tracker template provided you can take the following steps to fill out your Income statement. This is the balance sheet manually loaded uploaded through FDM or Smart View that was used to prepare the tax return final. The second is suspended losses that are computed after the excess dividends.

Current Year Tax Data Tax Accounts. Tax basis balance sheets have become increasingly important as there has been a shift of financial statement audit focus related to the accuracy of the tax. It should be prepared on an accrual basis.

Many times this analysis uncovers areas where a book tax difference should be in place and is not. This entry can be computed by subtracting the previous years book-basis balance sheet from the previous years tax-basis balance sheet on a line-item basis. Used under the accrual basis.