Spectacular What Means Current Liabilities In Brachets On Balance Sheet

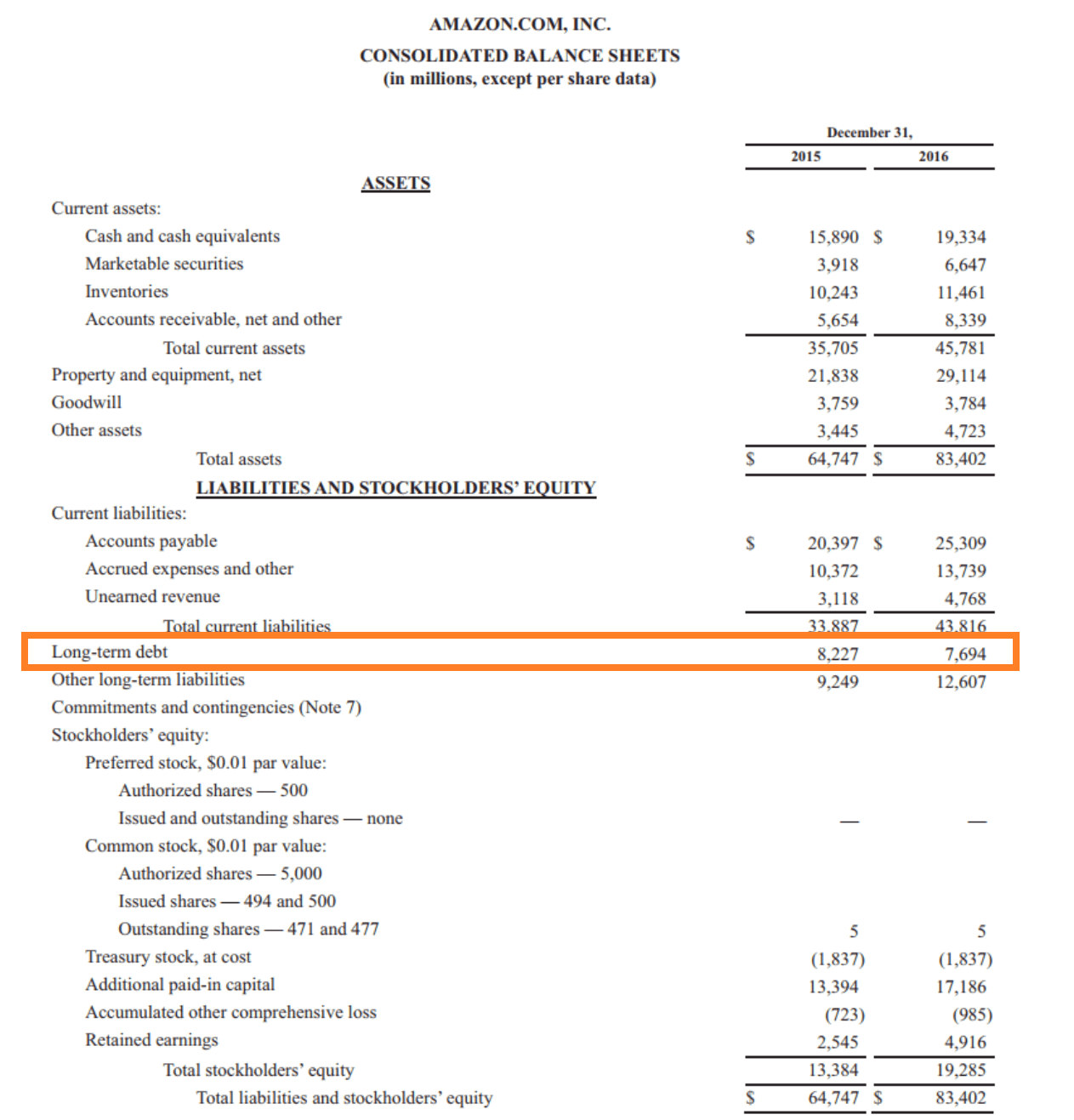

Bank loanoverdraft overdrawn balances on current accounts and loans.

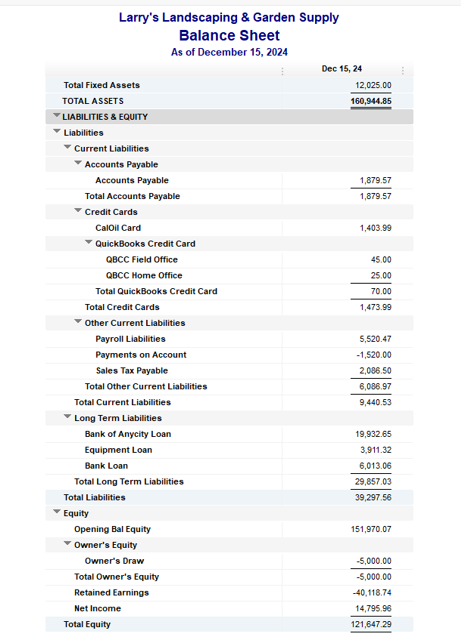

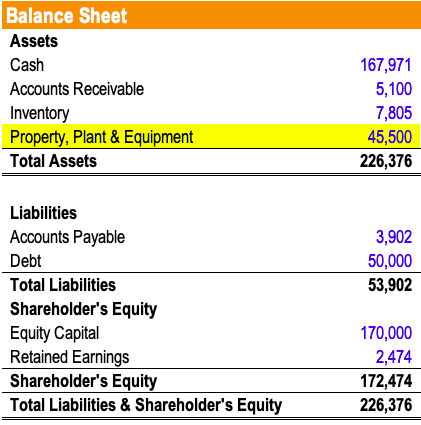

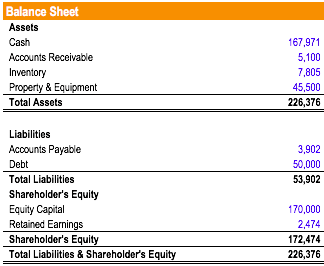

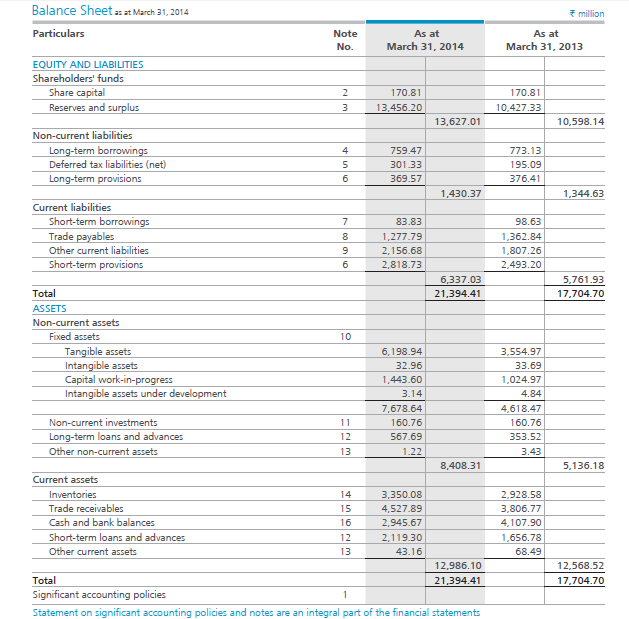

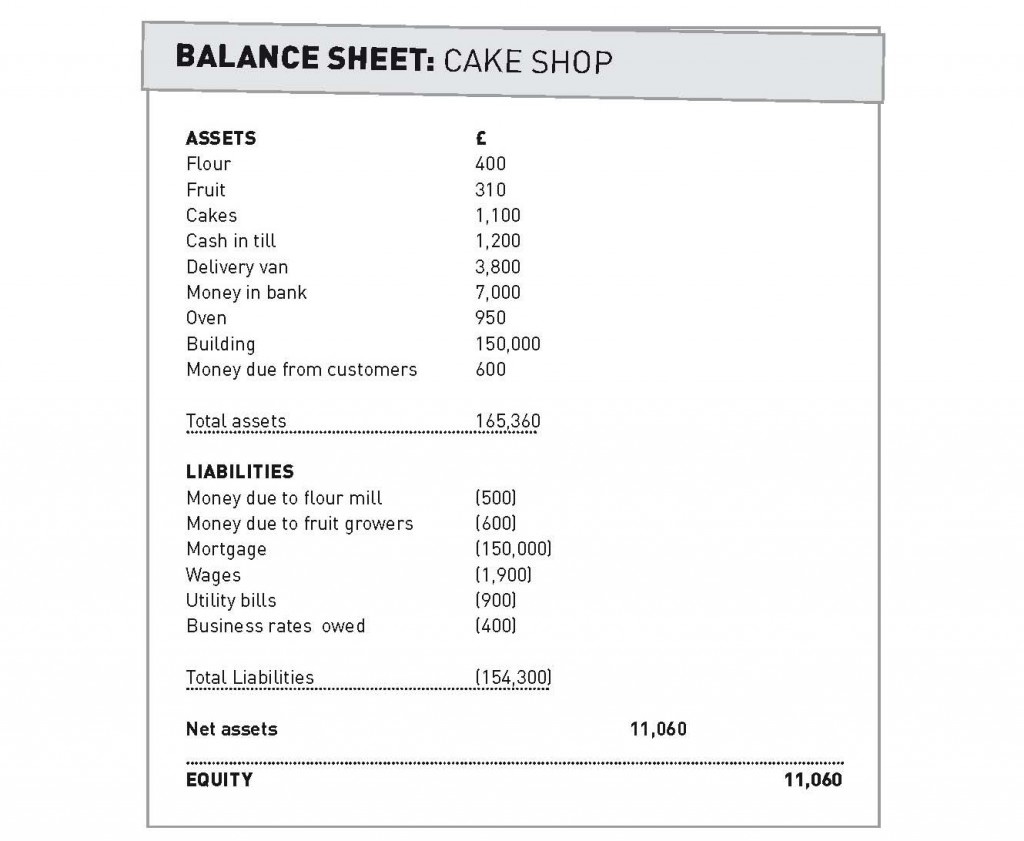

What means current liabilities in brachets on balance sheet. The Balance Sheet is a hugely important report and is divided into three main segments assets often divided into current assets and fixed assets liabilities and shareholder equity or retained earnings known as capital and reserves in KashFlow. A balance sheet is a set of numbers reported at a point in time which is usually at the end of a month or at the year end. Current Liabilities are payable within 12 months or the companys operating cyclefrom the date of the Balance Sheet.

Current liabilities are sometimes known as short-term liabilities. Current liabilities are typically settled using current assets. Taxes often current liabilities will include VAT corporation tax andor PAYENational Insurance.

Liabilities are obligations of a company to repay the other entities it has obtained credit from. Liabilities are a companys legal debts or obligations that arise during the course of business operations and include loans accounts payable mortgages deferred revenues and accrued expenses. Other current liabilities are debt obligations that are coming due in the next 12 months and which do not get a separate line on the balance sheet.

Current liabilities are a companys obligations that will come due within one year of the balance sheets date and will require the use of a current asset or create another current liability. The accounting software usually had an option to print the liability account balances on the balance sheet without the negative signs. If the companys operating cycle is longer than one year the length of the operating cycle determines whether a.

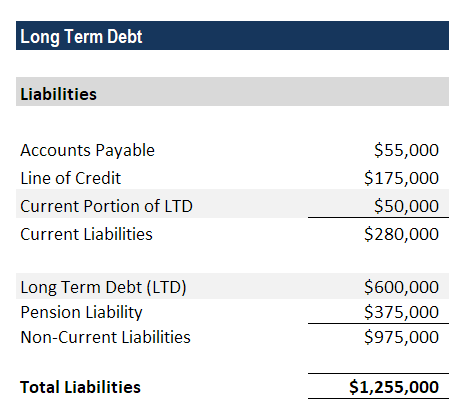

The current liabilities are obligations that must be settled within a period of 12 months. Current liabilities - what the business owes and must repay in the short term long-term liabilities - including owners or shareholders capital The balance sheet is so-called because there is a debit entry and a credit entry for everything but one entry may be to the profit and loss account so the total value of the assets is always the same value as the total of the liabilities. In this lesson youll learn about non-current liabilities and where they fit into a balance sheet.

Non-current liabilities are an important component of the financial health of a company. Contingent liabilities are those liabilities for which the company is still not legally responsible. On this financial statement is included fixed assets current assets short term liabilities long-term liabilities provisions capital and reserves.

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)