Amazing Ifrs 16 Deferred Tax Example

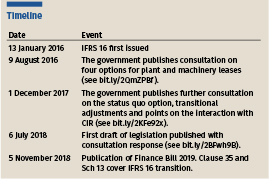

It can be applied before that date by entities that also apply IFRS 15 Revenue from Contracts with Customers.

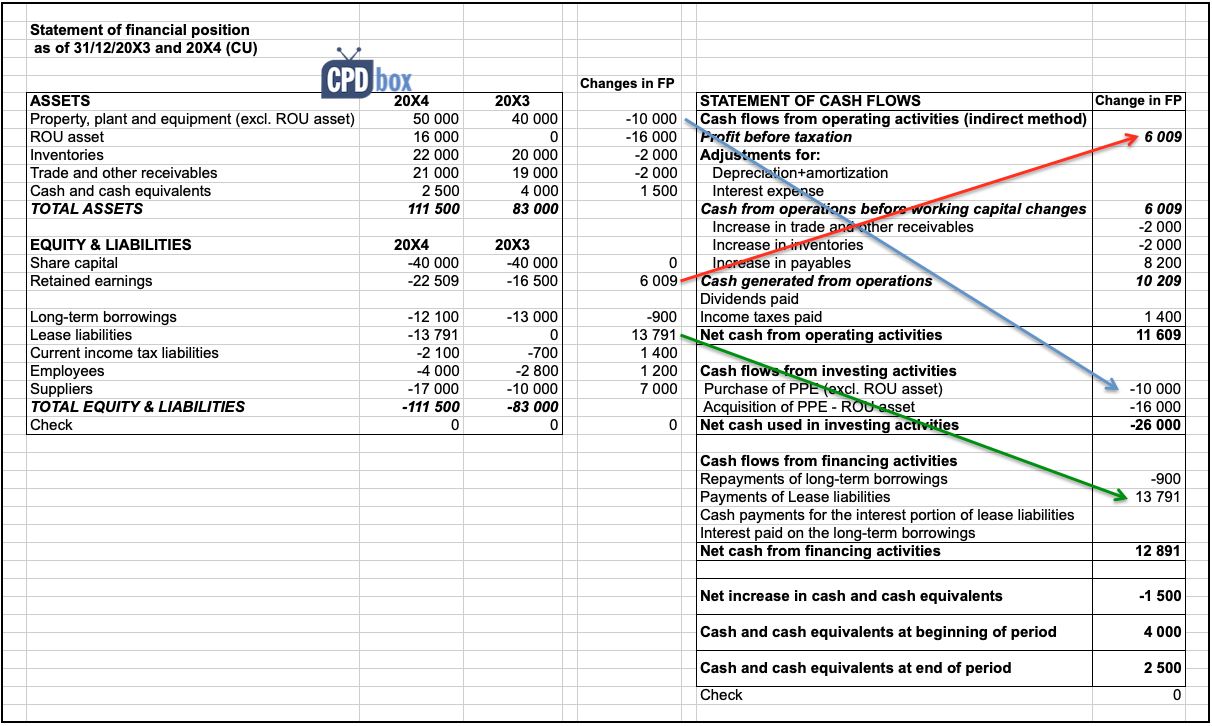

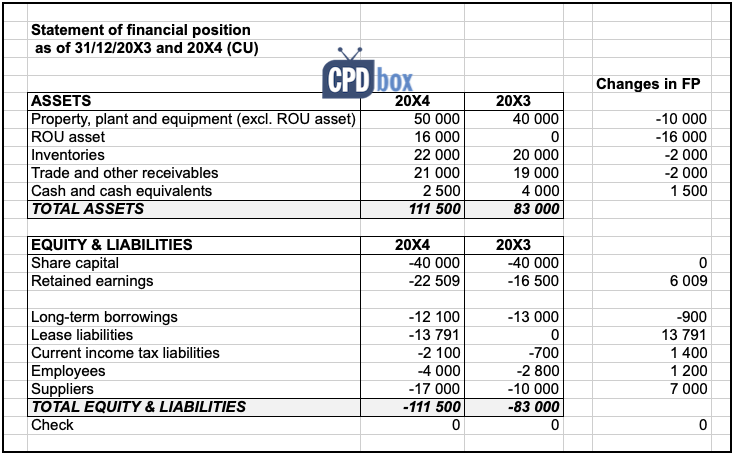

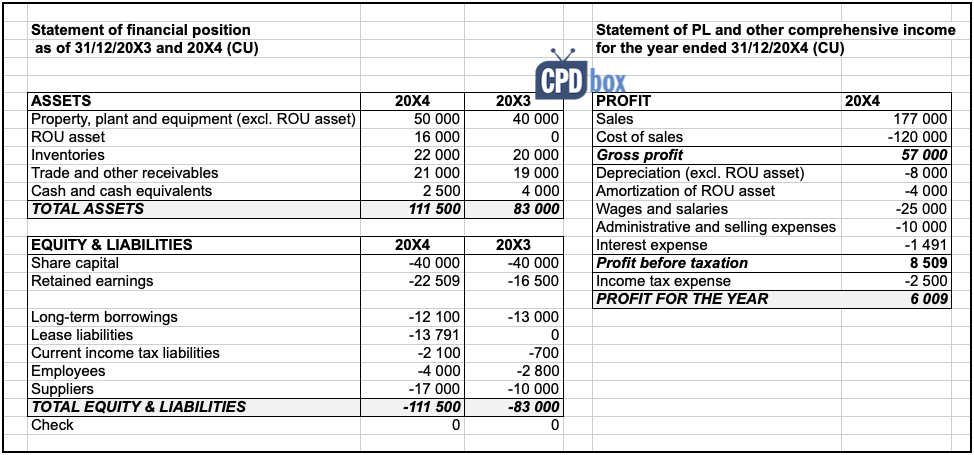

Ifrs 16 deferred tax example. IFRS 16 will require companies to bring most leases on-balance sheet from 2019 including leases which are currently classified as operating leases for example leases of land and buildings. The differences can be classed as permanent or temporary timing differences. Example 1 illustrates these concepts.

When lease payments are made. Namely the tax expense arises on a cash basis ie. Diminishing balance depreciation with residual value.

Simple calculation of defined benefit plan. Operating lease in the lessees accounts under IFRS 16 ABC the manufacturing company needs to adopt the new standard IFRS 16 Leases in the reporting period ending 31 December 2019. On 1 January 2019 the right-of use asset.

The introduction of IFRS 16 will also impact tax accounting as depending on the local tax law deferred tax and the ETR may be impacted. Lessee T rents a building from Lessor L for five years commencing on 1 January. Exemption for initial recognition of leases under IFRS 16 Entity A enters into a lease of an asset on 1 January 20X1.

The study materials discusses IFRS 16 and in fact the mid semester test had a question on calculation of IFRS 16 lease. Disclosure in the financial statements remains necessary. Calculating a deferred tax balance the basics IAS 12 requires a mechanistic approach to the calculation of deferred tax.

During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments. Cover some of the more complex areas of preparation of a deferred tax computation for example the calculation of deferred tax balances arising from business combinations. Sum of the digits depreciation.