Neat Cash Overdraft Balance Sheet

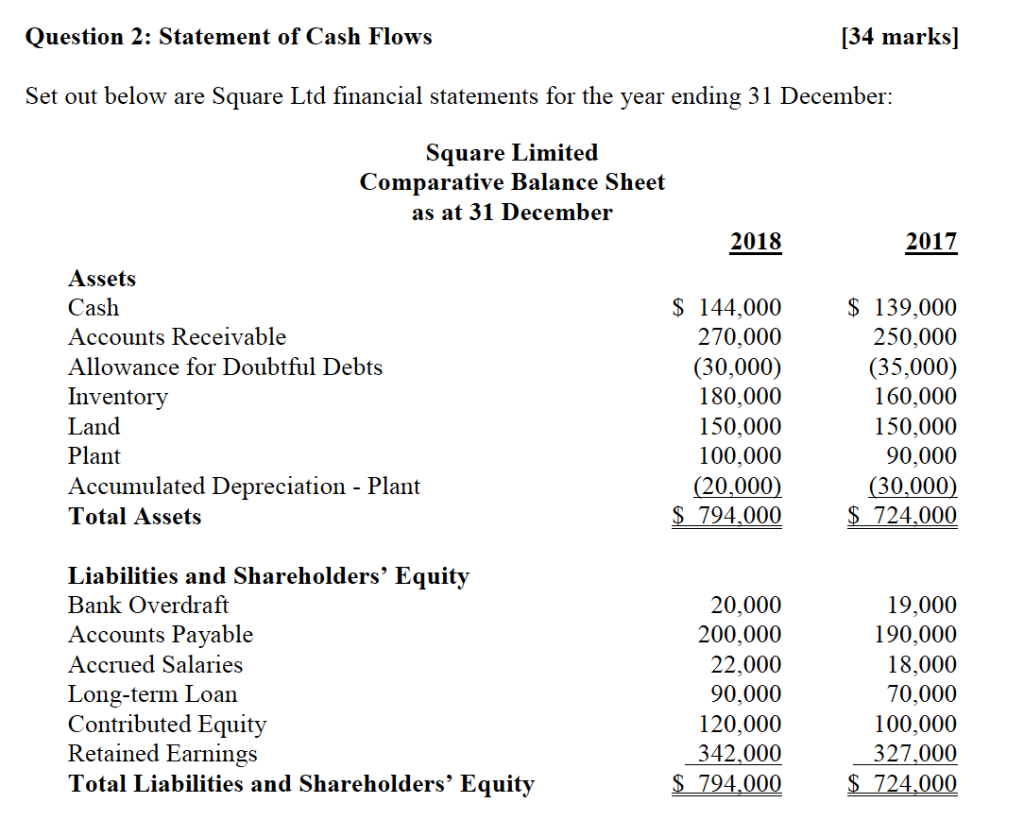

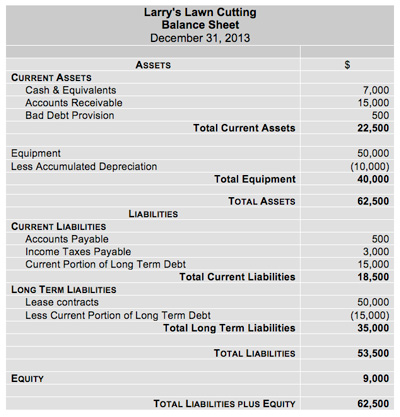

When a negative cash balance is present it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to automatically reverse.

Cash overdraft balance sheet. As per accounting terminology a bank overdraft is shown on the liability side of the balance sheet. Doing so shifts the cash withdrawal back into the cash account at the beginning of the next reporting period. This is due to the bank overdraft agreement is considered as an off-balance sheet item.

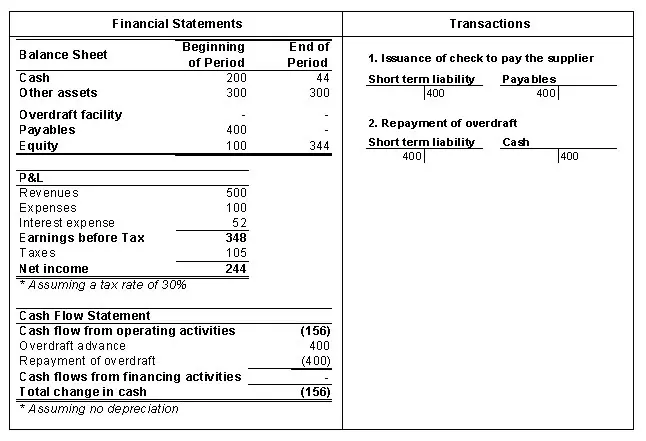

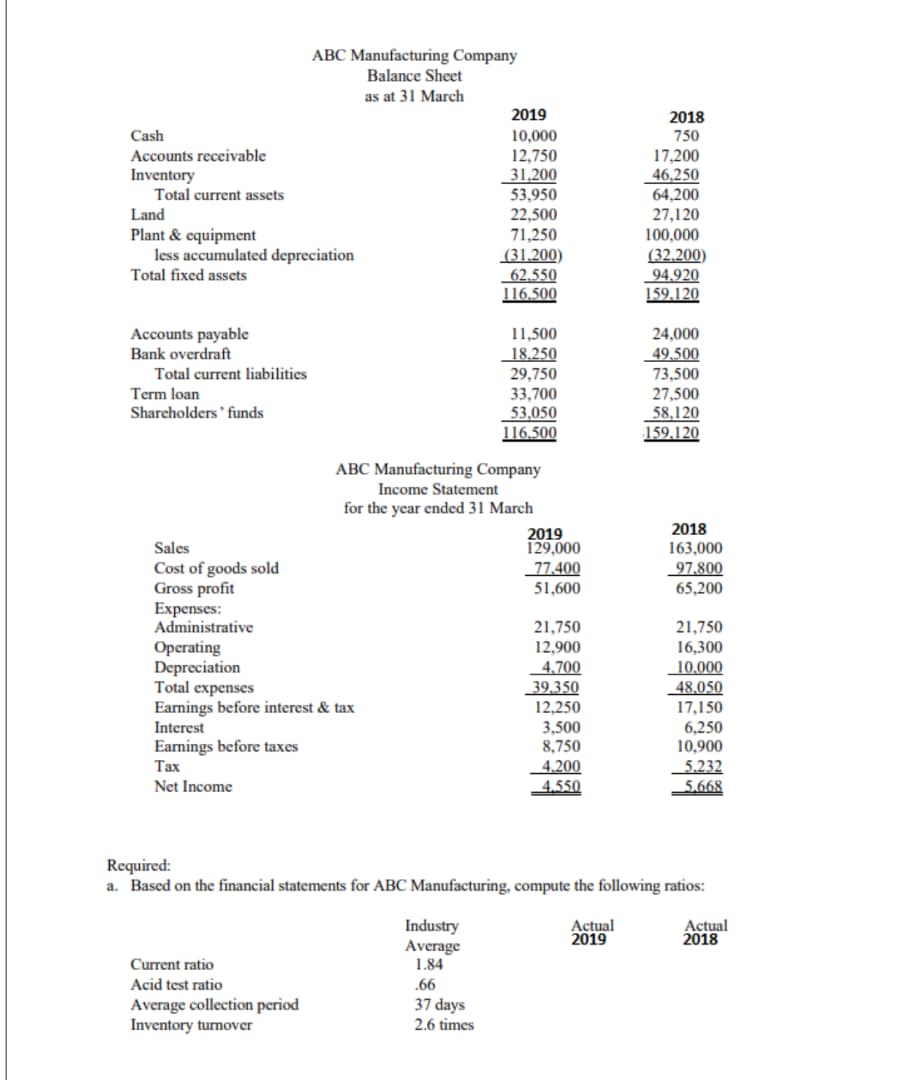

Bank overdrafts ie a negative bank account balance resulting from the bank covering cleared checks as presented or covering rejected deposits are required by AICPA Technical Practice Aid Technical Questions and Answers Section 130015 Presentation of Cash Overdraft on Statement of Cash Flows to be classified as a financing activity in the statement of cash flows. Book Overdrafts US GAAP A book overdraft represents the amount of outstanding checks in excess of funds on deposit for a particular bank account resulting in a credit cash balance reported on an entitys balance sheet as of a reporting date. Bank overdraft is again a tool that provides short term liquidity facility to the business.

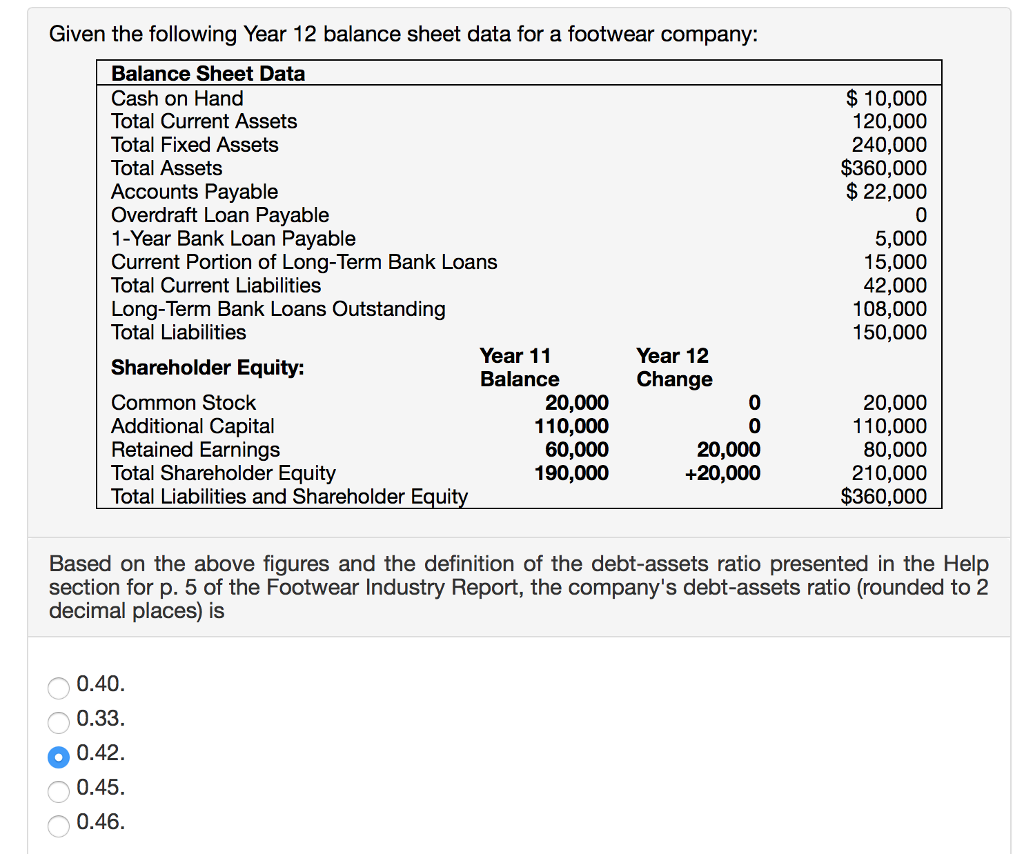

This situation typically arises when a person or business is too optimistic in assuming that deposited funds have cleared the bank and are available for use and so writes checks for which funds are not yet available. The overriding benefit is that companies have the ability to avoid. Or you can also include the amount in accounts payable.

Or you can also include the amount in accounts payable. This would entail listing it as an increase in cash flow an increase as a bank overdraft. Generally the bank overdraft in the balance sheet will be reported as a bank overdraft double entry.

Bank overdrafts are not common in the USA. They can only be included as a component of cash and cash equivalents if the banking arrangement is a bank overdraft that is repayable on demand and forms an integral part of the entitys cash management. If you are netting the three bank accounts consider using the Cash Overdraft option.

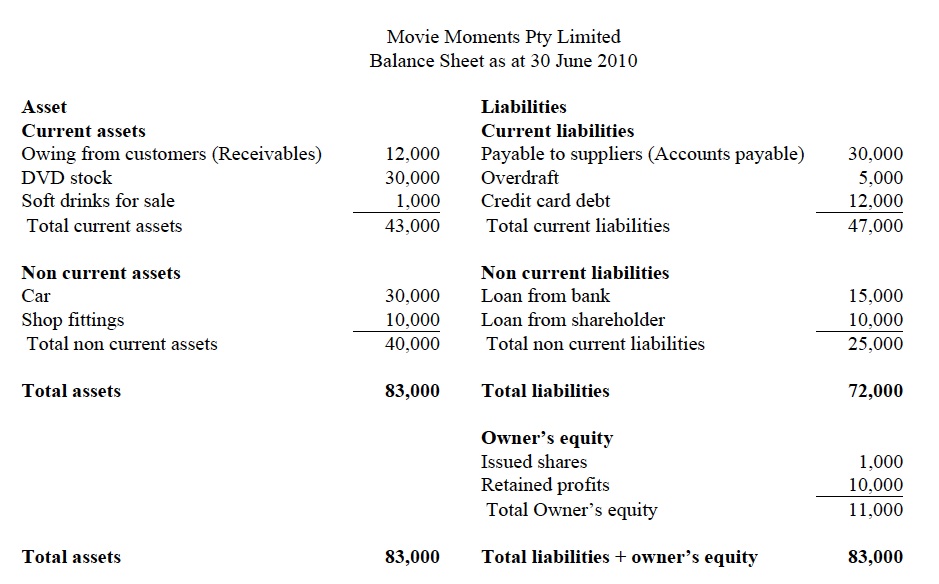

Machinery 100 Bank loan 75 Machinery 80 Bank loan 90 Factory 150. Cash-pooling is an instrument used to optimise corporate accounts. Business A Balance Sheet Business B Balance Sheet 31 Jan 2017 31 Jan 2017 ASSETS LIABILITIES ASSETS LIABILITIES Current.