Peerless Deferred Tax Liability Journal Entry

We have to create Deferred Tax liability Ac or Deferred Tax Asset Ac by debiting or crediting Profit Loss Ac respectively.

Deferred tax liability journal entry. A deferred tax asset represents the deductible temporary differences. Lessee T rents a building from Lessor L for five years commencing on 1 January. A deferred tax can also arise in event of an operating loss that can be carried forward to future periods for offsetting against future period taxable income.

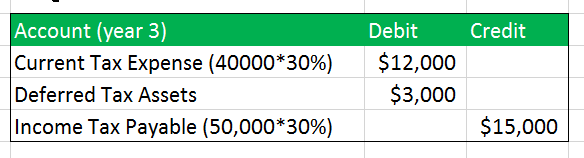

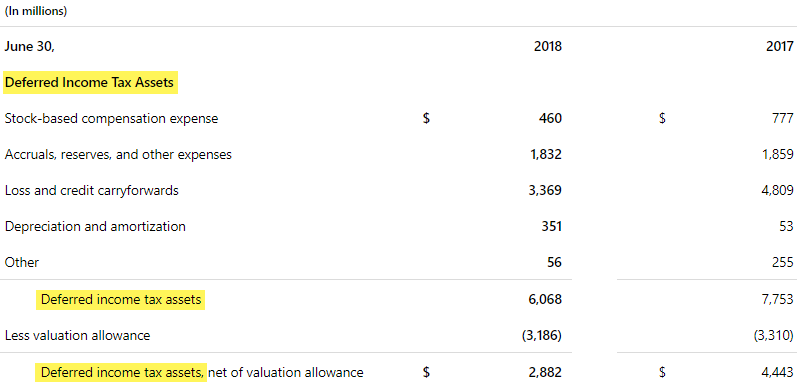

The tax valuation allowance is a contra asset meaning that its balance is subtracted from the deferred tax asset account to establish the balance sheet value for deferred tax assets. The Deferred Tax is created at normal tax rate. Journal entry for deferred tax Deferred Tax Asset Deferred Tax Liability Income Tax Expense Dr Cr 6 000 1 800 4 200 Additional explanations The deferred tax asset entry of 6000 relates to both the allowance and provision for LSL 3600 2400 The entries can be combined into a single entry for income tax as follows.

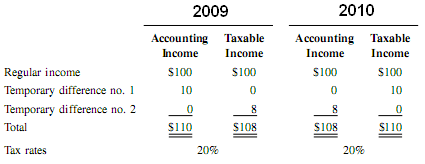

On 1 January 2019 the right-of use asset. Ts tax rate is 50. IAS 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable temporary differences.

The recognition of deferred tax assets is subject to specific requirements in IAS 12. Deferred rent journal entries under ASC 842 for year 1 Using the facts presented in this example the amortization table below is for the entire term of the lease. LesseeT Lessor L 5-year lease.

We have to create Deferred Tax liability Ac or Deferred Tax Asset Ac by debiting or crediting Profit Loss Ac respectively. The entry to establish a tax valuation allowance debits Income Tax Expense and credits the Deferred Tax Asset Valuation Allowance. To Deferred Tax Liability Ac 2 Deferred Tax Asset Ac.

Deferred tax assets are recognised only to the extent that recovery is probable. It arises when tax accounting rules defer recognition of income or advance recognition of an expense resulting in a decrease in taxable income in current period that would reverse in future. The Deferred Tax is created at normal tax rate.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)