Sensational Companies Act P/l

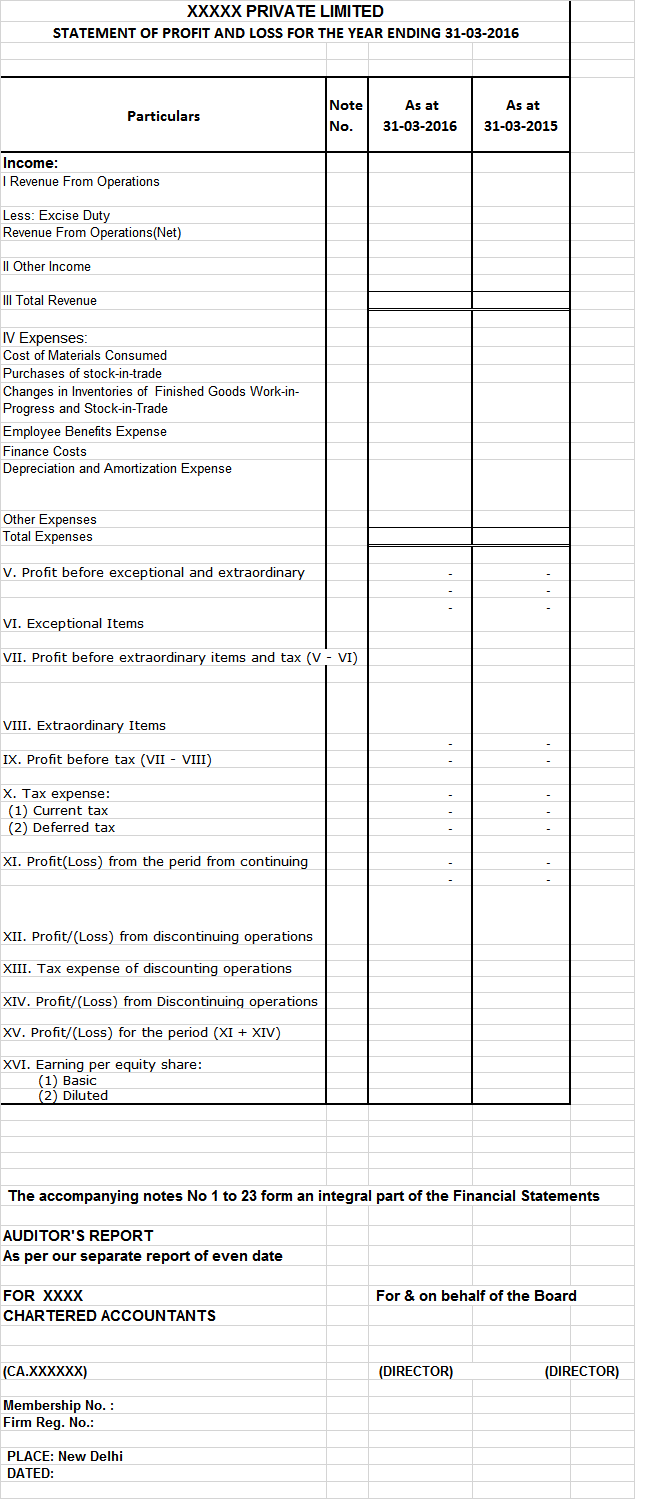

The horizontal format of P.

Companies act p/l. PL Format 3 Indian Company. 01-04-14CompaniesAct1956 Clause 32 of the Listing Agreement mandates Listed Companies to prepare CFS Neither AS 21 nor Companies Act 1956 requires other company to prepare CFS CompaniesAct2013 Mandatory for all Companies to prepare CFS in respect of the following entities. Section 129 of companies act 2013 provides for preparation of financial statements.

This combined with the fact theres no duty to enquire as to any limitation on the powers of the directors to bind the company 45 thus effectively abolishes the doctrine of constructive notice. In addition if a person dealing with the company knows that an act is beyond the powers of the directors under the companys constitution this would not constitute bad faith. The vertical format of PL Account.

2 The accounts must a in the case of the. Section 378L2 of Companies Act. Vesting of undertaking in Producer Company Section 378L1 of Companies Act.

Name cannot be deceptively similar to another registered company. Companies Filing Annual Returns Holding Annual General Meeting Registering a charge for companies Striking off a company Setting up Register of Registrable Controllers Updating information of a company include applying for alternate address Filing financial statements in XBRL format Common offences for companies. Subsidiary Company Associate Joint Venture Company.

2014 by the Companies Accounting Act 2017 in respect of a company qualifying for the small companies regime as a result of the transposition into Irish Law of the EU Accounting Directive 201334EU and some other minor amendments. 2 40 to include balance sheet profit and loss accountincome and expenditure account cash flow statement statement of changes in equity and any explanatory note annexed to the above. Anomaly in Definition of Free Reserves under Companies Act 2013 makes Companies Re-think about leaving credit in Profit Loss Ac Companies which have excess of Profit after appropriation for statutory reserves and dividend do have tendency to retain it as Surplus of the company rather than transferring it to any Reserves which are Free Reserves for the company.

Merchant Shipping Miscellaneous Amendments Act 2019 Commencement Notification 2021 Supreme Court of Judicature Amendment Act 2019 Commencement No. For accounts filing deadlines that fall after 5 April eligible companies can still apply for a 3-month extension. In India there are basically two formats of PL statements.

/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)