Awesome Off Balance Sheet Activities Examples

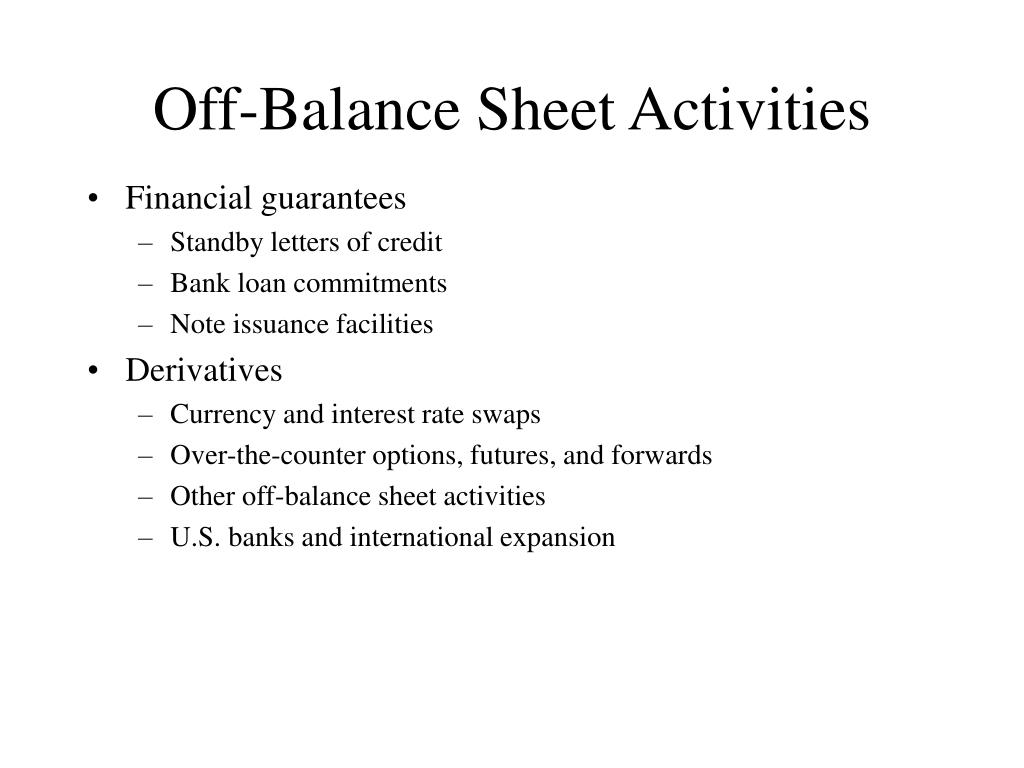

Off-balance sheet commitments occur when a bank guarantees a customer payment through a standby letter of credit or an interest rate swap or foreign exchange commitments.

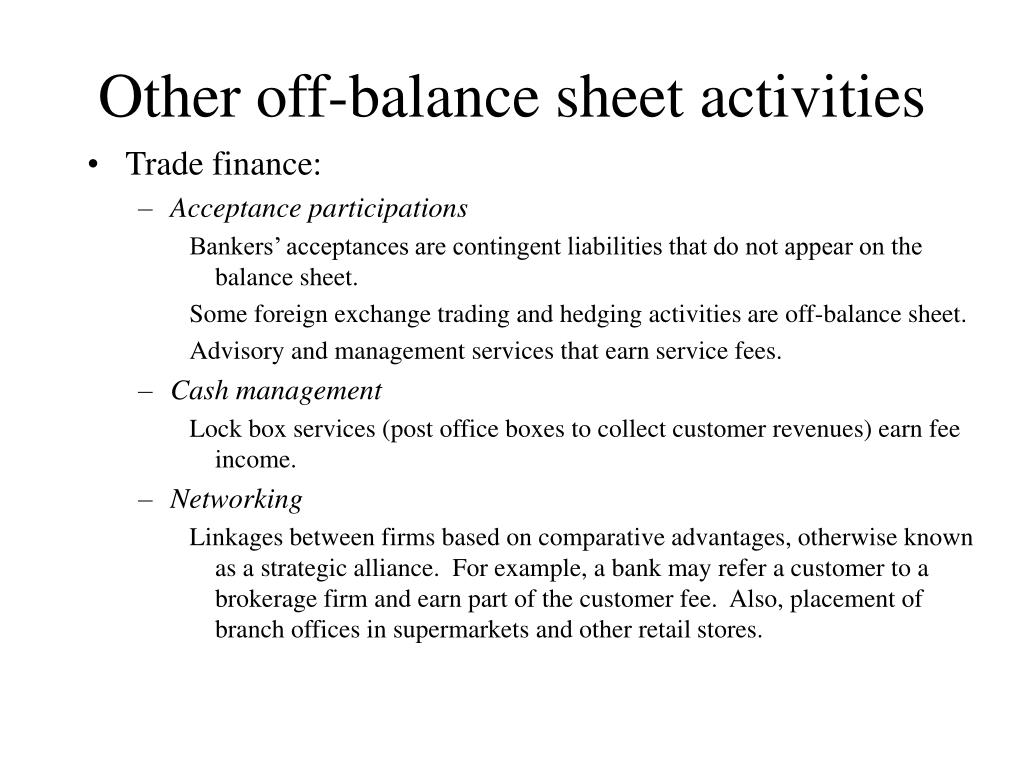

Off balance sheet activities examples. C back-up lines of credit. Published on January 27 2017 January 27 2017 20 Likes 1 Comments. Contingent liabilities are different from off-balance sheet items as the former is only mentioned when the liability is likely and the obligation can be quantified.

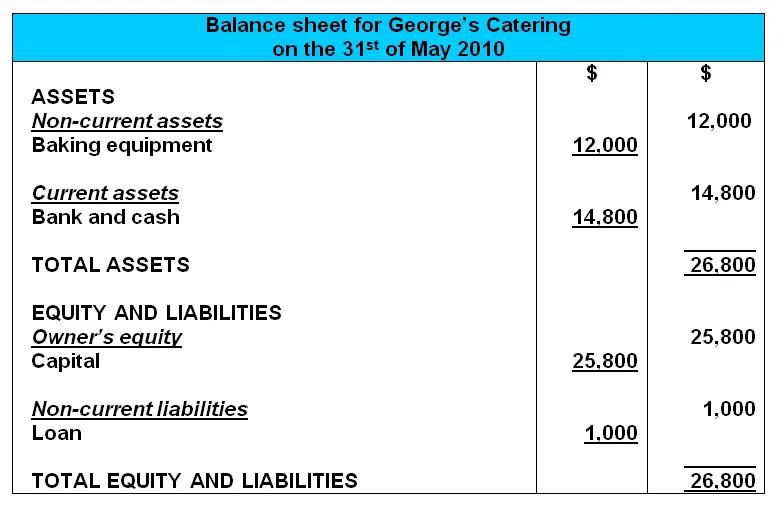

In this case the assets being managed by firms do not belong to them but to the clients so they are not recorded on the balance sheet. Although not recorded on the balance sheet they are still assets and liabilities of the company. Journal of Accounting Auditing Finance.

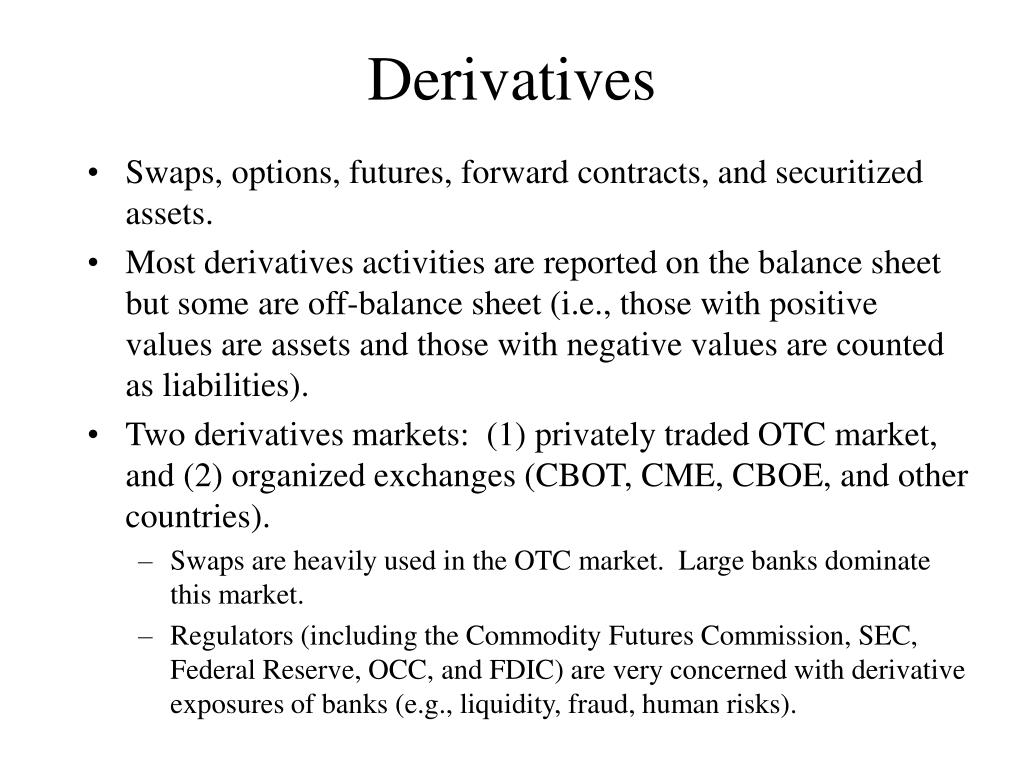

B extending loans to depositors. B guaranteeing debt securities. During the past couple of decades financial institutions have sharply expanded their off-balance sheet activities.

Under some economic conditions the bank could be exposed to too much risk. This trend has been fostered by the stepped-up pace of financial innovation. Examples of Off-Balance Sheet Assets OBS assets allow companies to keep assets and liabilities off the balance sheet.

OBS accounting activities targeted by the Accounting Standards Boards The FASB and IASB released their new lease accounting standards in early 2016. Off Balance Sheet Debt - 6 Sales securitization of Receivables or hiding receivables and payables of f-balance sheet Before we examine receivable securitization. Examples of off-balance-sheet activities include A trading activities.

The role of OBS activities in the financial crisis of 2007-2008. 4 Issue 2 p111-124. D selling negotiable CDs.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)